LATEST NEWS ON PRE IPO COMPANIES

follow the news on the most interesting pre ipo companies.

Epic Games' Legal Clash with Google

Epic Games, the powerhouse behind Fortnite, is confronting Google in court over app marketplace fees. As Epic v. Google unfolds, the stakes are high; the verdict could redefine digital commerce. Our pre-IPO platform offers a unique chance to invest in Epic Games' bold challenge before they go public, potentially capitalizing on the company's push for market transformation.

#EpicGames #IPOAnalysis #StockTrends

AI Hardware and Systems: Cerebras or SambaNova Systems?

Explore the competitive landscape of AI hardware: Cerebras and SambaNova's valuations suggest high growth expectations, while NVIDIA, AMD, and Intel's varying multiples paint a diverse picture of investor sentiment, emphasizing the value in lower multiples.

Kraken expansion in Europe is good business.

Discover Kraken's bold expansion across Europe, acquiring key crypto players in Belgium, the Netherlands, Spain, and Ireland. These strategic moves signal strong growth potential, aiming to boost its pre-IPO value amidst a dynamic digital currency landscape. Dive into Kraken's visionary strategy for European dominance in the burgeoning world of cryptocurrency.

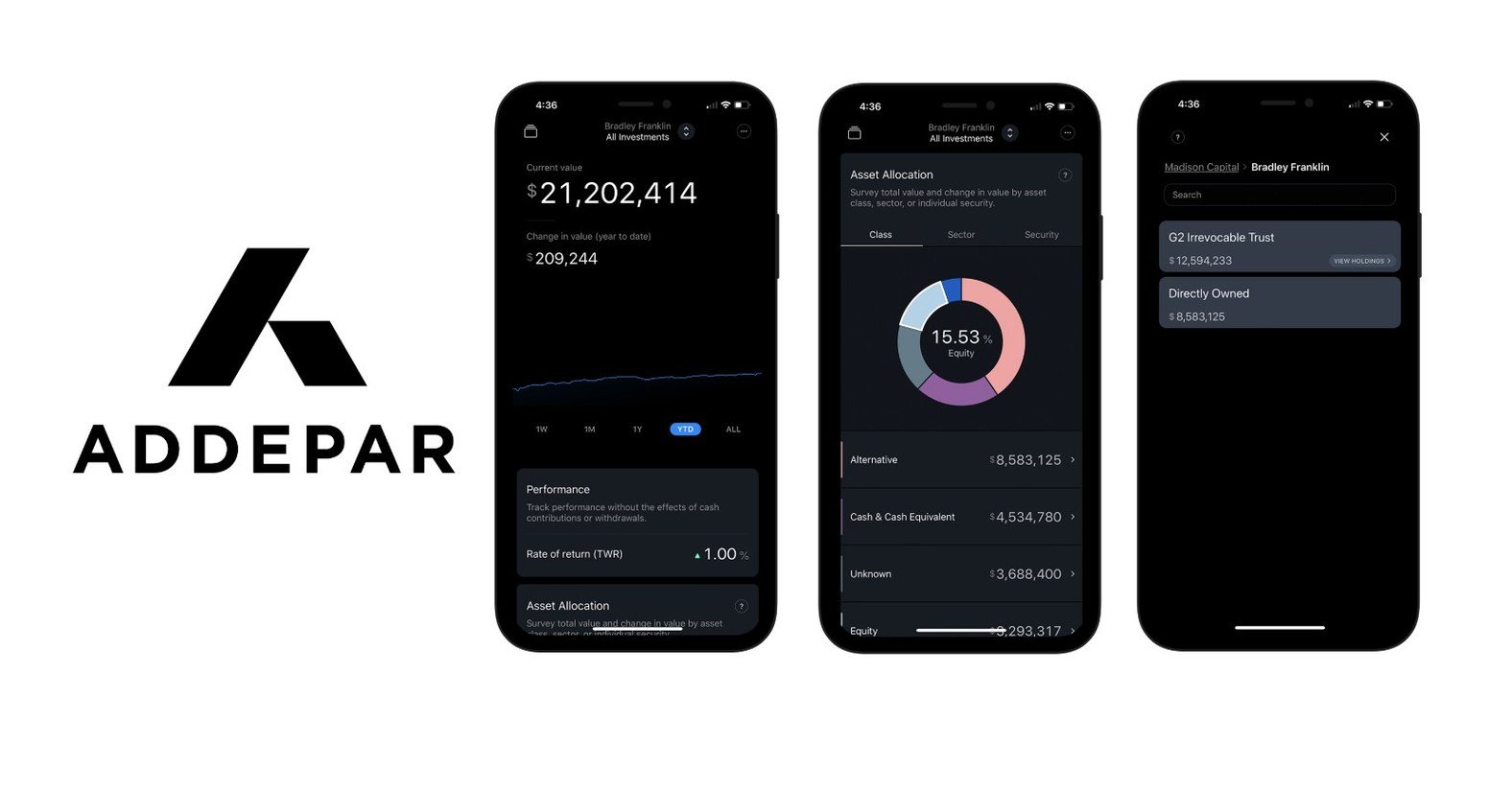

Addepar Seizing the Moment in Wealth Technology

Discover Addepar's 2023 triumph in wealth management technology. This article delves into Addepar's innovative strategies and significant growth, highlighting their $5 trillion asset management milestone and advanced AI integrations. Learn how Addepar redefines investment management with its global expansion and cutting-edge tech solutions.

The Ingenious Innovation of Impossible Foods' Beef Lite

Impossible Foods' introduction of Beef Lite signifies a strategic move in the plant-based sector, emphasizing nutritional superiority with 21g protein and no cholesterol. Targeting the heart-healthy segment and adhering to American Heart Association standards, could enhance the company's financial trajectory, adding to its #1 selling status in U.S. retail plant-based meats. Sustainability, a core company value, is also a major draw for eco-conscious consumers. The launch of Beef Lite may propel Impossible Foods' revenue in the health-centric and eco-friendly markets.

Exploiting the Lag Between Nasdaq and Private Markets for Arbitrage

Dive into the dynamic interplay between Nasdaq trends and private markets with IPO CLUB. Leverage insights on arbitrage opportunities from Anduril's growth against defense sector giants for smart pre-IPO investments. Stay ahead with IPO CLUB's savvy analyses. #PreIPOStrategies #MarketArbitrage #DefenseStocks #IPOCLUB

Interest Rate and Investor Behavior

Understanding market dynamics is crucial for investors. As interest rates plateau, the potential for asset valuation recovery grows. Proactive investment in select late-stage companies may capitalize on the shifting macroeconomic environment, offering a strategic advantage in the face of ever-changing market conditions.

Flexport acquires convoy’s technology

Flexport's acquisition of Convoy assets, excluding liabilities, complements its strategic realignment towards profitability. This move, deemed modest in cost, enhances Flexport's technological stack, potentially lowering carrier costs and augmenting its logistics services. Amidst workforce reductions and a pivot to operational efficiency under CEO Ryan Petersen, this acquisition positions Flexport to leverage Convoy's innovations and customer base for competitive advantage.

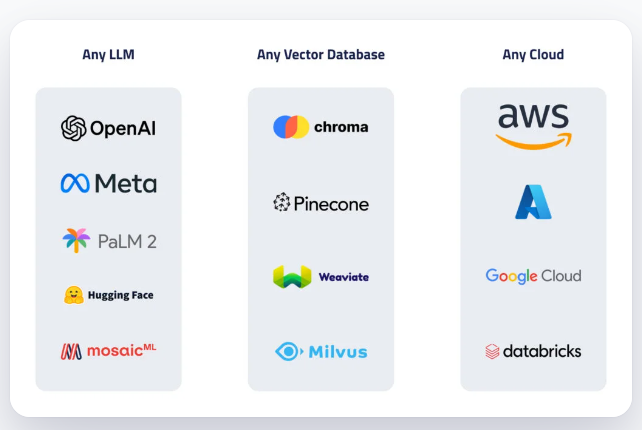

Anthropic, OpenAI, and Datarobot

In the wake of Google's $2B investment in Anthropic and Microsoft's significant stake in OpenAI, our focus shifts to DataRobot's unique position in the AI sector. With a diversified focus on AI, DataRobot is a compelling potential target for M&A. As AI industry consolidation accelerates, understanding these key players is crucial. Subscribe to our club letter for exclusive DataRobot IPO insights.

Former Expedia CFO joins Plaid

Plaid, the fintech firm, appoints former Expedia CFO Eric Hart as its first CFO. Speculation on IPO plans while diversifying revenue streams and emphasizing security in payments.

OpenAI Seeks $86 billion valuation

OpenAI's valuation soars to $86 billion, driven by AI advancements. Employee stock sale in discussion. ChatGPT's rapid growth fuels OpenAI's success in the chatbot industry.

Newcleo signs MOU with Nuclear AMRC

The NewCleo-Nuclear AMRC partnership aims to drive nuclear innovation, enhancing supply chain readiness, modularization, and manufacturability. It supports NewCleo's plan-to-market strategy for advanced modular reactors, contributing to decarbonizing electricity generation. With collaborations and acquisitions, NewCleo strengthens its position in the nuclear industry, poised for global impact.

Flexport cuts staff to gain profitability

Flexport, the digital freight forwarder, announces a 20% staff reduction, aiming to regain profitability amid industry challenges. Learn more about this strategic move and its impact on Flexport stock price.

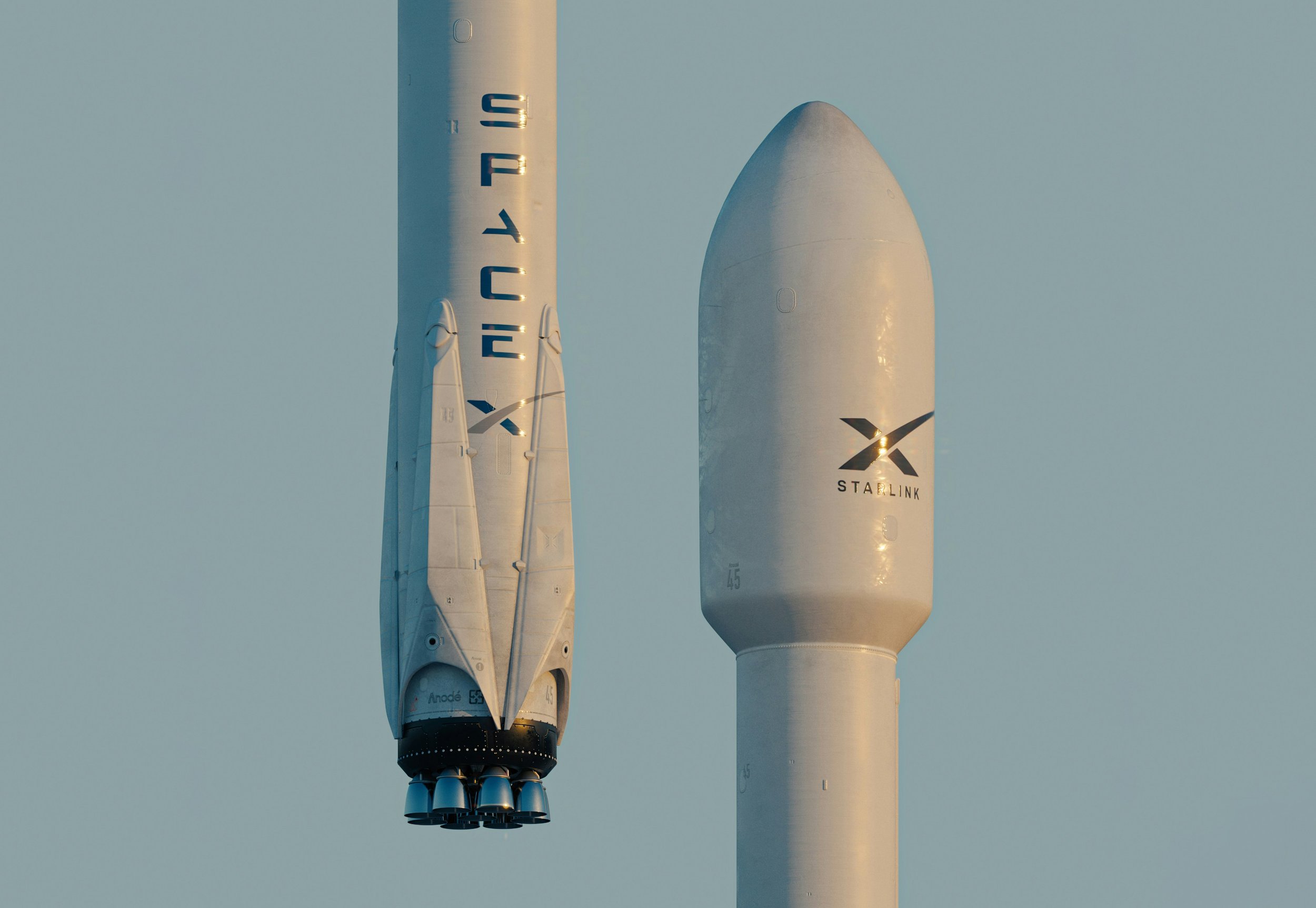

Maersk adds SpaceX Starlink systems on 330 ships

Danish logistics leader Maersk partners with SpaceX's Starlink for high-speed internet on 330+ container ships. Boosting connectivity at sea and digitalizing vessel operations.

Epic Games' Strategic Restructuring: A short Analysis

Epic Games' stock price stabilization hints at strategic restructuring and potential IPO considerations. The company's moves to enhance financial health and CEO Tim Sweeney's transparent statements could pave the way for a public listing. Dive deeper into our analysis and learn about the implications of Epic's recent actions. Note: Always consult with a financial advisor before making investment decisions.

#EpicGames #IPOAnalysis #StockTrends

Natilus Blended-Wing-Body Aircraft for defense

Natilus is transforming the aviation and defense sectors with its next-gen blended-wing-body (BWB) aircraft, promising heightened aerodynamic efficiency and payload capacity. Tailored for the commercial freight sector, this innovation promises to overhaul outdated transport methods, positioning air freight as a prime commodity. Leveraging its prowess, Natilus targets defense contracts, notably the USAF's $40B Next Generation Air-refueling System. Plus, with a 40% cut in CO2 emissions, the BWB design redefines sustainability in aviation.

Q3 Selected stock prices according to “Valuation at Market©”

The rules for “Valuation at Market©” are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to Certificates of Incorporation, Limited Offering Exemption Notices, Employee Plan Exemption Notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month but distributed on a quarterly basis, before the last day of each January, April, July, and October.

Taleb on Instacart's IPO pricing

Considering Taleb's insights, it's evident why understanding risk and reward in venture capital is pivotal. A venture capitalist might anticipate that many investments will fail, but they're worthwhile if just one becomes a Black Swan success. By appreciating the asymmetric nature of investments, investors can navigate venture capital more effectively. It's essential to internalize Taleb's principles to maintain a strategic perspective.

SpaceX stock price

We discuss SpaceX's recent valuation surge to approximately $150 billion following a secondary share sale. This transaction primarily involved existing shares without a fresh capital infusion. Elon Musk previously indicated there was no urgent capital need for their Starship and Starlink ventures. Notably, such secondary sales are semi-annual events for SpaceX, allowing internal stakeholders to liquidate shares. The share price has appreciated 5% from its previous secondary sale.

OpenAI Stock investment memo

Founded in 2015, OpenAI has emerged as a key player in the AI arena, notable for its GPT series and ethical AI commitment. Its collaboration with giants like Microsoft enhances its position. The AI market's vast potential offers significant growth, though challenges from competitors and regulatory bodies persist. Given OpenAI's innovation trajectory and emphasis on safe AI deployment.