Epic Games' Strategic Restructuring: A short Analysis

Epic Games, a major player in the gaming industry known for its groundbreaking developments and platforms, recently announced a significant restructuring move.

As investors in Epic Games, we are very interested in the latest developments:

Key Restructuring Decisions

1. Employee Layoffs: Epic Games has disclosed that it will be laying off roughly 830 employees. This accounts for approximately 16% of the company's total workforce.

2. Divestments: In a notable divestment strategy, the company has decided to pull back its investments from Bandcamp, an online music platform that had previously piqued its interest.

3. Spin-off of Super Awesome: The company is also making moves to spin off a majority stake in Super Awesome, a digital engagement tool suite specifically designed for brands targeting a younger demographic.

CEO's Perspective

Tim Sweeney, the CEO of Epic Games, voiced his concerns about the company's financial trajectory. He stated, “For a while now, we've been spending way more money than we earn, investing in the next evolution of Epic and growing Fortnite as a metaverse-inspired ecosystem for creators. I had long been optimistic that we could power through this transition without layoffs, but retrospectively, I see this was unrealistic.”

Sweeney's statement candidly acknowledges the company's challenges. His words hint at Epic Games' ambitious vision, especially regarding Fortnite's evolution as a platform beyond just a game.

Fortnite's Revenue Structure

Fortnite's recent growth patterns underscore its unique strategy. Content generated by creators has predominantly fueled the game's expansion. A couple of months prior, Epic Games had made headlines by increasing its revenue-sharing model, thereby promising creators a larger slice of the revenue pie. This move was strategic, aiming to attract more content creators and offer a more lucrative platform for them. However, it also indicates that the company might have stretched its financial boundaries to incentivize content creation.

Future Implications and Employee Support

The announced layoffs and divestments primarily focus on fortifying the company's financial foundation. Such decisions are never easy but often stem from a broader vision of ensuring long-term growth and sustainability. Epic Games has assured them of a severance package along with additional support to ease the transition for affected employees.

Analysis of Epic Games' Share Price Movement

While evaluating the immediate impacts of such strategic decisions is essential, it's equally vital to look at the long game. Epic Games' restructuring could be pivotal in ensuring its sustained growth in an ever-evolving gaming industry. The company's actions underscore its commitment to adaptability and resilience, two traits imperative for success in today's volatile business environment.

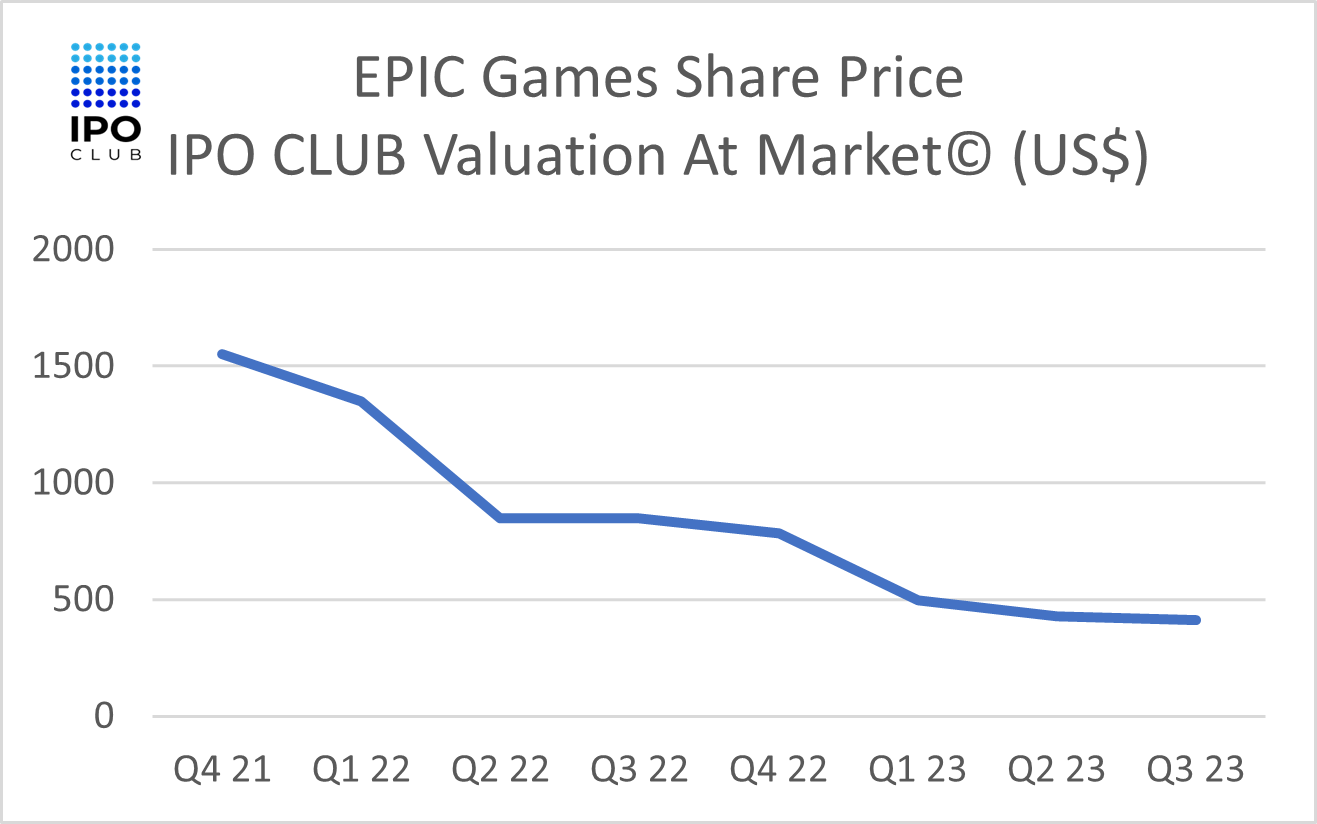

The chart illustrates Epic Games' share price trajectory as assessed by IPO CLUB from Q4 2021 through Q3 2023.

Description of Epic Games stock Price Movement

Starting in Q4 2021, Epic Games' stock was valued at approximately $1,500. As we transitioned to Q1 2022, there was a noticeable decline, bringing the valuation down slightly above $1,000. This downward trend continued with a more gradual slope through Q2 2022 to Q4 2022, with the stock's value stabilizing around the $500 mark. From Q1 2023 to Q3 2023, the price movement shows a relatively flat line, suggesting that the stock price has found some stability and consolidation around the $500 level.

wHY WE LIKE EPIC GAMES stock AT THESE LEVELS

Stabilized Price Point: The stock has shown relative stability over the last three quarters, hovering around the $500 mark. This consistency suggests that the stock might have found its bottom, which traditionally indicates a lesser risk of further significant decline.

Historical Highs: Considering the stock once traded at around $1,500, the current price of $500 may be perceived as undervalued, especially if the company's fundamentals remain strong and its restructuring strategies are expected to bear fruit in the long run.

Strategic Changes: Epic Games' recent announcements of restructuring, divestments, and other strategic shifts suggest that the company is positioning itself for a rebound. Successful restructuring can often lead to cost savings and more efficient operations, potentially driving future profitability and, by extension, share price appreciation.

Fortnite's Potential: As Fortnite continues its evolution towards a metaverse-inspired ecosystem, any success in this venture can provide significant growth opportunities for Epic Games, which could reflect positively on its stock price.

Epic Games IPO

The share price movement and strategic decisions made by Epic Games can provide insights into the potential timing and strategy behind its IPO. Here's an analysis based on the presented data:

Stabilizing Share Price: The stabilized share price around the $500 mark over several quarters suggests Epic Games may look for a more stable valuation before considering an IPO. Companies often seek to go public when they believe their stock is at a fair or attractive valuation to raise the maximum amount of capital.

Strategic Restructuring: The layoffs, divestments, and spin-offs highlight that Epic Games is taking steps to strengthen its financial position and streamline operations. Such restructuring moves are often seen in companies gearing up for an IPO, aiming to present themselves in the best financial light to potential investors.

CEO's Statement: Tim Sweeney's acknowledgment of financial challenges and the company's steps to address them can be viewed as a move towards transparency. Such transparency is vital for a company considering going public, as it will face scrutiny from regulators, analysts, and potential shareholders.

Market Reception: While the share price has declined from its highs, the stabilization suggests that the market has absorbed most of the company's recent news. If Epic Games can showcase a promising trajectory in its operations and financials in the coming quarters, it may find a receptive market for its IPO.

more info on EPIC Games stock? subscribe to our club letter

CONCLUSION

Today, Epic Games is one of the largest independent publishers in the world with full-stack potential—with its own games, the Epic app store, the Unreal game engine, and the metaverse, based on its blockbuster game # Fortnite.

It trades around 3.3x 2023 projected revenues. As a comp, Activision was acquired at an 8x multiple, Roblox is trading at 9x, and Unity at 6x.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.