AI Hardware and Systems: Cerebras or SambaNova Systems?

Explore the dynamic landscape of AI hardware:

Discover how Cerebras Systems and SambaNova Systems drive AI's future, from generative AI advancements by OpenAI to ethical AI development. Delve into the tech shaping AI's transformative impact on society.

The companies are currently offered on the secondary market at a deep discount on their respective latest financing round:

Sambanova Systems -60% to last Funding Round (Apr 2021)

Cerebras Systems -55% | Last Funding Round: (Nov 2021)

Comparison

The primary differences between SambaNova Systems and Cerebras Systems are their architectural approaches to AI and specific solutions for AI workloads.

Cerebras Systems is known for its wafer-scale integration approach, embodied in its Wafer-Scale Engine (WSE-2). This massive chip enables Cerebras to perform parallel computations for artificial intelligence tasks, which is particularly useful in machine learning applications. The WSE-2 is designed to provide near-perfect linear scaling of large language models (LLMs) and deep-learning models with many parameters.

SambaNova Systems, on the other hand, has adopted a systems approach, constructing a complete solution encompassing custom chips, firmware, software, and integrated data and memory systems. Their DataScale servers can perform both AI training and inference tasks, which helps eliminate the need for expensive data movement. SambaNova's approach is to deliver rack-level accelerated systems that include integrated networking and proprietary interconnects for model parallelism. They have recently released the second generation of DataScale systems, which feature improvements in processor speed and memory capacity, indicating a continued focus on enhancing the performance of their AI systems.

In summary, Cerebras focuses on maximizing computational performance through wafer-scale technology for tasks that can benefit from highly parallel processing, such as training large language models. SambaNova offers an integrated system solution that is designed to handle a wide range of AI tasks, including both training and inference, with the flexibility afforded by their custom architecture. Both companies are contributing to the advancement of AI hardware but with distinct strategies and offerings.

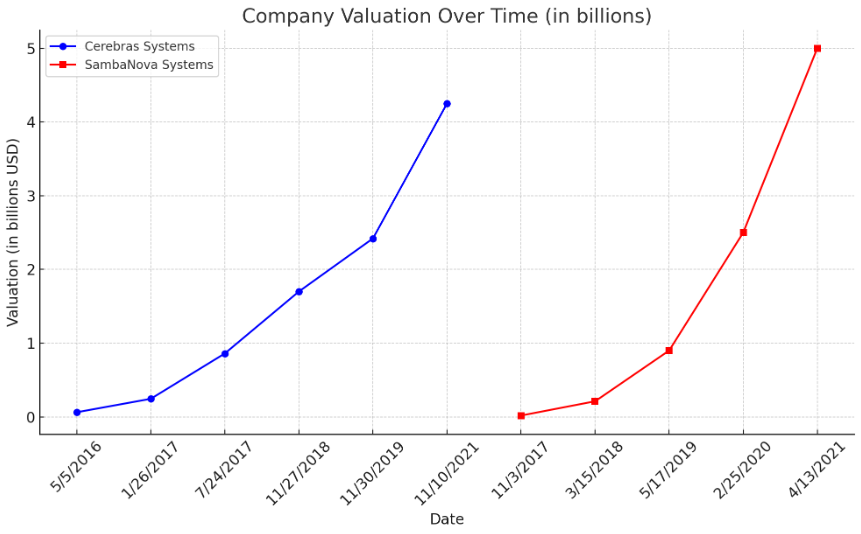

Comparing funding history since inception

From an investor's perspective, the potential success of SambaNova Systems and Cerebras Systems would hinge on multiple factors, including market demand, scalability of technology, adaptability, partnerships, and financial health.

Cerebras Systems’ unique wafer-scale integration technology positions it as a strong contender in sectors that require massive computational power, such as government labs, large research institutions, and companies with large-scale AI tasks. The ability to effectively scale large language models is a significant competitive advantage, particularly as the demand for more complex AI models grows.

SambaNova's systems approach might appeal to a broader market segment, offering flexibility and a comprehensive solution that includes hardware and software. This could make it attractive to a wider range of businesses that require turnkey solutions for AI applications, not just those with the most intensive computational needs.

Both companies are operating in a rapidly growing market with increasing demands for AI capabilities. The better investment would depend on the match between each company's strategic direction and the investor's own criteria for performance, risk tolerance, and the investor's assessment of the AI market's evolution. It's also worth considering the companies' financials, management teams, track records, and any proprietary technology or patents that could affect their long-term viability and competitive edge.

An investor should conduct a thorough due diligence process, considering both quantitative data such as financial metrics and qualitative factors such as management quality and technological edge, to determine which company aligns best with their investment thesis.

Cerebras Systems shows a steady growth in valuation over time, starting from a modest $62.5 million in May 2016 and reaching $4.25 billion by November 2021. The company's valuation growth appears consistent, with significant jumps following the Series D and Series F rounds.

SambaNova Systems, in contrast, presents a more rapid valuation increase, particularly between the Series B round in May 2019 and the Series D round in April 2021, where the valuation soared from $900 million to $5 billion. This steep increase reflects a substantial growth in investor confidence and market potential perceived in the company's technology and business model.

The trajectories of both companies show robust growth trends, albeit at different paces and scales, which is common in the highly dynamic and competitive field of AI technology. SambaNova's recent valuation surpasses that of Cerebras. Still, both companies have achieved multi-billion dollar valuations within a few years of their respective inceptions, indicating strong market positions and potential for future growth.

Secondary market valuation in the last six months

Cerebras Systems began with a notable valuation of $1.9 billion in May, which suggests a period of strong investor confidence, possibly buoyed by innovative product developments or favorable market conditions. However, this period was followed by a significant decrease in valuation, dropping as low as $960 million in August before partially recovering to $1.1 billion by October. This decrease could reflect various factors, such as market reactions to company strategic direction changes, performance below investor expectations, or broader economic downturns affecting the tech sector.

In contrast, SambaNova's valuation presents a story of an upward trend and growing investor optimism. Starting from $2.8 billion in May, the valuation surged to a high of $2.7 billion in July, slightly dipping in the following months but stabilizing at $1.1 billion by October. This robust growth trajectory indicates a company scaling effectively, with potential market expansion and successful capitalization on the demand for AI solutions.

From an investor's standpoint, SambaNova's valuation history over the last six months may present a more compelling narrative. Despite the slight dip towards the end, the company's ability to maintain a multi-billion-dollar valuation reflects a robust business model and investor confidence in its long-term growth and market position.

The sharp valuation drop for Cerebras Systems, on the other hand, may raise questions about its sustainability and future prospects. While such a drop can sometimes provide a lucrative opportunity for investors to buy in at a lower valuation, it also carries a higher risk if the underlying reasons for the decline are not addressed.

In conclusion, SambaNova's relatively stable and high valuation suggests a company succeeding in its market strategies and one that investors believe is well-positioned to capitalize on the future of AI technology. Cerebras Systems, with its more volatile valuation, might require investors to have a higher risk tolerance and a belief in the company's potential to rebound and grow in the long term.

The publicly listed comparable companies

The five-year stock price performance of NVIDIA, AMD, and Intel showcases distinct trajectories for these key players in the AI hardware and semiconductor industries. NVIDIA has demonstrated exceptional growth, with its stock price soaring by approximately 1,075.75%, indicative of its strong market position and successful expansion into AI and data center markets. AMD's performance is also noteworthy, with an impressive increase of around 474.01%, reflecting successful product launches and a competitive edge in both the CPU and GPU markets. Intel, however, shows a decrease of 20.42% over the same period, which might highlight challenges faced in innovation and competition despite being one of the largest and most established semiconductor companies. The chart reflects the rapidly changing landscape of technology investments and the varying ability of companies to capitalize on the surging demand for AI and computing performance.

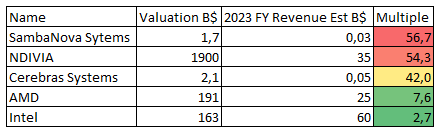

Valuation and multiple comparisons

The valuation chart provides a snapshot of the forward-looking revenue multiples for SambaNova Systems, NVIDIA, Cerebras Systems, AMD, and Intel. SambaNova and NVIDIA exhibit high multiples, suggesting that investors are willing to pay a premium for their growth prospects, with SambaNova at 56.7 times and NVIDIA at 54.3 times their estimated 2023 revenues. Cerebras Systems, with a multiple of 42.0, also indicates a strong growth expectation but at a somewhat less aggressive valuation than its peers in the high-growth segment.

On the other end of the spectrum, AMD and Intel present much lower multiples, at 7.6 and 2.7, respectively, pointing to a more conservative growth outlook from the market. Such lower multiples may suggest that these stocks could offer value opportunities; they might represent a more attractive buy for investors looking for potentially undervalued companies in the sector, especially if they believe in the companies' long-term prospects to increase their revenues or if the market has unduly discounted their growth potential. Buying into lower multiples, if justified by solid fundamentals, can provide a larger margin of safety and the possibility for significant returns if the companies outperform market expectations.

AI Hardware and Systems growth trends

The domain of AI hardware and systems is at a transformative juncture, fueled by the escalating demands of generative AI applications, which range from natural language processing to image and video synthesis. The evolution of this sector has been marked by remarkable progress, where the synergy between hardware performance and algorithmic innovation is pivotal. As generative AI models, like those developed by OpenAI and Anthropic, become more sophisticated, the underlying hardware must correspondingly advance to enable the massive computational workloads these models demand.

Generative AI is concurrently driving and being driven by these hardware innovations. The field has made waves with technologies capable of generating indistinguishably human-like content, automating creative processes once thought to be the exclusive domain of human intellect. From GPT-3’s text generation to DALL-E’s image creation capabilities, these models are a tour de force of algorithmic ingenuity and a testament to the hardware that sustains them. The synergy between the two is set to deepen, with AI models becoming more integral to the design and testing of the very hardware platforms that will, in turn, run future generations of AI.

The potential of AI hardware is immense, as it doesn't merely aim to keep pace with software advancements but also to catalyze new breakthroughs. As generative AI models grow in sophistication, they are expected to undertake tasks of increasing complexity and sensitivity, such as medical diagnostics, autonomous systems, and personalized education, necessitating a robust and secure hardware foundation. This has placed AI hardware firms at the forefront of a technological renaissance, where the emphasis is on creating systems that are powerful but also versatile, energy-efficient, and accessible to a broader spectrum of users and applications.

Looking to the future, the trajectory of AI hardware and systems is bound to intersect with quantum computing and neuromorphic technologies, forging new paradigms in computational efficiency. As AI becomes more pervasive in society, ethical considerations and sustainability will become increasingly influential in designing and deploying AI hardware. Players like OpenAI and Anthropic, focusing on scalable, ethical AI, will likely continue to shape the conversation around how AI should evolve, promoting a vision where AI serves as a universal, democratizing force.

Conclusion

The evolution of AI hardware and systems is an unfolding saga of innovation and adaptation, set against the backdrop of generative AI’s relentless advance. The potential for transformative impact across all sectors of society is unparalleled, with hardware developers and AI research organizations playing pivotal roles. As this dance between hardware capability and software ingenuity continues, we will likely witness a redefinition of what is possible within the realm of artificial intelligence and beyond into the fabric of our daily lives. Therefore, the future of AI hardware and systems is not just about the technology itself but the new frontiers it will enable us to explore.

learn more about Live opportunities

The opportunities involve investing in companies that are expected to go public soon. These opportunities are attractive because they allow investors to purchase shares before their IPO, potentially leading to significant returns if the company's public debut is successful and the stock price increases.

Interesting Reads

Cerebras Systems signs $100 mln AI supercomputer deal with UAE's G42

Startup Cerebras stands out in the high-risk AI chip arena: 'No one has built a chip this big

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.