Taleb on Instacart's IPO pricing

“Difficulty is what wakes up the genius.”

Instacart IPO Pricing

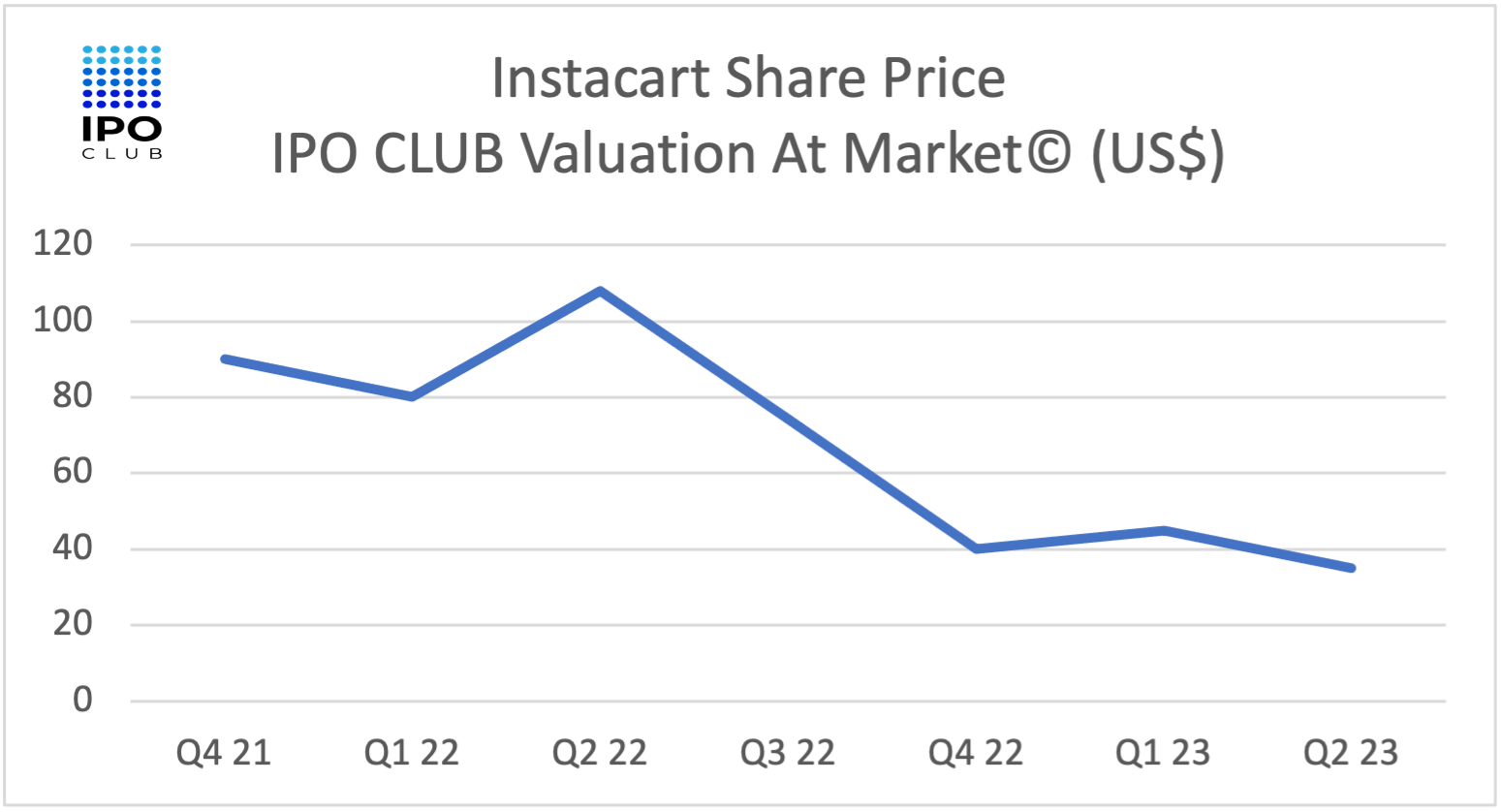

Instacart is pricing its IPO between $8.6 billion and $9.3 billion.

77% below its last primary round,

25% below its last announced internal valuation of $12 billion in March 2023, and

below the September 4, 2023, pre-IPO secondary market implied valuation of $12.8 billion.

We are not alone; when we invested in 2021, Instacart raised $265 million as part of a new financing round from existing investors including Andreessen Horowitz, Sequoia Capital, D1 Capital Partners, Fidelity Management & Research Company LLC, and T. Rowe Price Associates, Inc., and everybody agreed that Instacart was a good buy at a valuation of $39 billion.

Starting from this low IPO pricing, $CART has a good chance of going up in the public market. We wish the company and its management well in this process 🚀

Taleb’s Wisdom on the Instacart IPO Pricing

Nassim Nicholas Taleb, the author of the "Incerto" series, which includes books like "Fooled by Randomness," "The Black Swan," "Antifragile," and "Skin in the Game," has commented on various aspects of risk, randomness, and uncertainty that can be applied to the world of venture capital. However, he hasn't written a book solely on venture capital.

Some of the concepts Taleb introduces are directly relevant to the venture capital world:

Extremistan vs. Mediocristan

Taleb explains the distinction between two types of randomness. Mediocristan represents systems where the bell curve (or normal distribution) applies and where the outcomes are not significantly impacted by one observation. In contrast, in Extremistan, a single observation can hugely skew the averages. Venture capital, where a single successful investment can generate returns that overshadow dozens of failures, is a classic example of Extremistan.

Black Swan Events

These are rare and unpredictable events that have a massive impact. In the world of startups and venture capital, a "black swan" company might be one like Google or Facebook that achieves outsized success compared to most other startups. That’s why we invest in the private markets—to be part of the great success stories in the making.

Antifragility

This concept relates to systems that gain from disorder. In venture capital, a portfolio approach is taken where many bets are made on various startups, knowing that many will fail, but a few might succeed spectacularly. This system as a whole can be seen as antifragile, as failures don't break the system but are an expected part of it.

Skin in the Game

Taleb posits that decision-makers should bear the risks of their decisions. Venture capitalists and pre-IPO investors have "skin in the game" when investing their money and time into ventures.

While Taleb doesn’t write exclusively about venture capital, many of the principles he discusses provide valuable insight into the industry's inherent risks and rewards.

What’s the lesson here?

Considering Taleb's insights, it becomes evident why understanding the nature of risk and reward in venture capital is pivotal. When entering into a deal that has a high probability of financial loss, it might seem counterintuitive or irrational.

However, in the context of Extremistan and the world of venture capital, it's not individual wins or losses that matter, but the aggregate or cumulative effect of a portfolio of bets.

A venture capitalist might anticipate that many investments will fail, yet they are still worthwhile if just one or two become Black Swan successes, delivering returns that eclipse the losses from other ventures.

By appreciating the asymmetric nature of these investments—where the downside is limited to the initial investment but the upside can be virtually limitless—one can navigate the landscape of venture capital more effectively. Thus, it's essential for investors to internalize Taleb's principles, ensuring they're not merely 'fooled by randomness' and can maintain a strategic, long-term perspective even in the face of probable short-term failures.

What is IPO CLUB

We are a club of Investors with a barbell strategy: very early and late-stage investments. We leverage our experience to select investments in the world’s most promising companies.

Disclaimer

Private companies carry inherent risks and may not be suitable for all investors. The information provided in this article is for informational purposes only and should not be construed as investment advice. Always conduct thorough research and seek professional financial guidance before making investment decisions.