LATEST NEWS ON PRE IPO COMPANIES

follow the news on the most interesting pre ipo companies.

Pre-IPO strategies for December and Q1 2024

Explore "Strategic Venture Capital Investment Approaches" for Dec and Q1 2024. Highlighting Momentum strategy with companies like OpenAI and SpaceX, Deep Value with DataRobot and Epic Games, and Quick Exit strategy featuring Ripple and Rubrik, this guide delves into smart investment moves for upcoming financial quarters.

November sanity check

November Sanity Check delves into the latest private market trends, offering a portfolio manager's perspective on the month's performance. We analyze key decisions, market shifts, and emerging opportunities, providing insights into our strategic choices and their impact on your investments. This month's review is crucial for understanding market dynamics and our approach to navigating them, ensuring informed decisions and optimal outcomes for our Members.

Crypto Market Bounces Back

The overall trend for the cryptocurrency market in November 2023 was upward, indicating a recovery phase with increased market capitalization, positive momentum across various cryptocurrencies, and increased investor engagement.

Impossible Foods stock update Q4 2023

In a challenging alternative meat market, Impossible Foods stands out with growth in U.S. retail, defying a sector downturn. Notably, their Impossible Beef Lite has received American Heart Association certification, emphasizing health benefits with 75% less saturated fat than lean beef, 21g of protein, and vital micronutrients. This aligns with consumer health trends, bolstering Impossible Foods' market position amidst broader category struggles.

Automation Anywhere Announces Strong Third Quarter FY24

Automation Anywhere's third-quarter success, marked by a 35% increase in large deal values, showcases the impact of its GenAI-enhanced products. With over 50% of bookings from deals over $100,000, the company's growth in North America, APJ, India, and the Middle East is notable. CEO Shukla credits GenAI solutions for 30% of bookings, highlighting their role in solving complex challenges and driving profitability.

Kraken charged by the sec.

The SEC has charged Kraken for operating an unregistered crypto trading platform. Kraken allegedly merged exchange, broker, dealer, and clearing agency roles without SEC registration, neglecting vital investor protections. The SEC's legal action seeks to ensure compliance with securities laws, safeguarding investor interests in the evolving crypto industry.

OpenAI Turmoil: Investor Legal Challenge Amidst Leadership Crisis

OpenAI faces a leadership crisis following the ousting of CEO Sam Altman, sparking potential mass employee resignations and investor legal action. Investors fear significant losses in the generative AI leader, while the company's unique structure complicates their recourse.

Ripple Update thanksgiving 2023

Ripple and XRP are redefining global payments, notably with their recent expansion into Africa and beyond through a partnership with Onfariq. This move has led to a significant increase in XRP's market cap, reflecting growing confidence in Ripple's network for efficient cross-border transactions. Ripple's innovative approach, leveraging XRP as a bridge currency and securing critical regulatory milestones, positions it as a leader in transforming international financial transfers.

How DataRobot's AI Innovation Shapes the Future of Business

DataRobot CEO Debanjan Saha emphasizes trust in AI, advocating for a culture that drives innovation with a clear mission, risk-taking, and data-driven decision-making.

Epic Games' Legal Clash with Google

Epic Games, the powerhouse behind Fortnite, is confronting Google in court over app marketplace fees. As Epic v. Google unfolds, the stakes are high; the verdict could redefine digital commerce. Our pre-IPO platform offers a unique chance to invest in Epic Games' bold challenge before they go public, potentially capitalizing on the company's push for market transformation.

#EpicGames #IPOAnalysis #StockTrends

AI Hardware and Systems: Cerebras or SambaNova Systems?

Explore the competitive landscape of AI hardware: Cerebras and SambaNova's valuations suggest high growth expectations, while NVIDIA, AMD, and Intel's varying multiples paint a diverse picture of investor sentiment, emphasizing the value in lower multiples.

Kraken expansion in Europe is good business.

Discover Kraken's bold expansion across Europe, acquiring key crypto players in Belgium, the Netherlands, Spain, and Ireland. These strategic moves signal strong growth potential, aiming to boost its pre-IPO value amidst a dynamic digital currency landscape. Dive into Kraken's visionary strategy for European dominance in the burgeoning world of cryptocurrency.

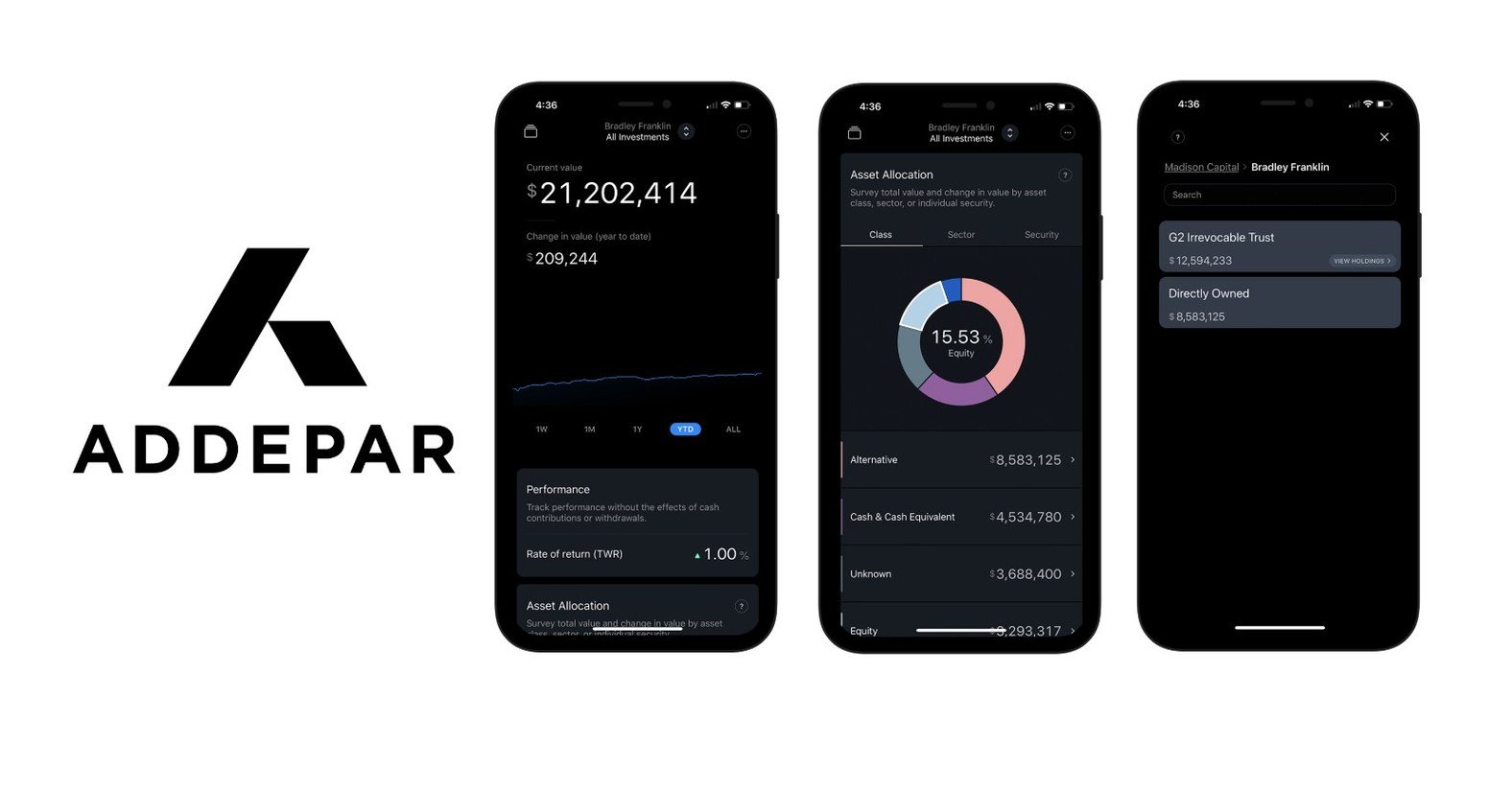

Addepar Seizing the Moment in Wealth Technology

Discover Addepar's 2023 triumph in wealth management technology. This article delves into Addepar's innovative strategies and significant growth, highlighting their $5 trillion asset management milestone and advanced AI integrations. Learn how Addepar redefines investment management with its global expansion and cutting-edge tech solutions.

The Ingenious Innovation of Impossible Foods' Beef Lite

Impossible Foods' introduction of Beef Lite signifies a strategic move in the plant-based sector, emphasizing nutritional superiority with 21g protein and no cholesterol. Targeting the heart-healthy segment and adhering to American Heart Association standards, could enhance the company's financial trajectory, adding to its #1 selling status in U.S. retail plant-based meats. Sustainability, a core company value, is also a major draw for eco-conscious consumers. The launch of Beef Lite may propel Impossible Foods' revenue in the health-centric and eco-friendly markets.

Exploiting the Lag Between Nasdaq and Private Markets for Arbitrage

Dive into the dynamic interplay between Nasdaq trends and private markets with IPO CLUB. Leverage insights on arbitrage opportunities from Anduril's growth against defense sector giants for smart pre-IPO investments. Stay ahead with IPO CLUB's savvy analyses. #PreIPOStrategies #MarketArbitrage #DefenseStocks #IPOCLUB

Interest Rate and Investor Behavior

Understanding market dynamics is crucial for investors. As interest rates plateau, the potential for asset valuation recovery grows. Proactive investment in select late-stage companies may capitalize on the shifting macroeconomic environment, offering a strategic advantage in the face of ever-changing market conditions.

Flexport acquires convoy’s technology

Flexport's acquisition of Convoy assets, excluding liabilities, complements its strategic realignment towards profitability. This move, deemed modest in cost, enhances Flexport's technological stack, potentially lowering carrier costs and augmenting its logistics services. Amidst workforce reductions and a pivot to operational efficiency under CEO Ryan Petersen, this acquisition positions Flexport to leverage Convoy's innovations and customer base for competitive advantage.

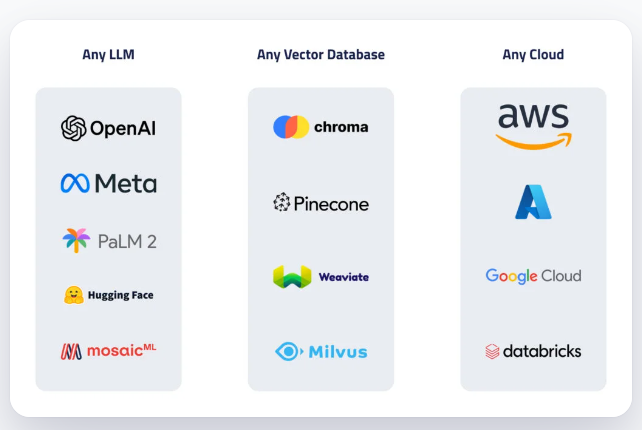

Anthropic, OpenAI, and Datarobot

In the wake of Google's $2B investment in Anthropic and Microsoft's significant stake in OpenAI, our focus shifts to DataRobot's unique position in the AI sector. With a diversified focus on AI, DataRobot is a compelling potential target for M&A. As AI industry consolidation accelerates, understanding these key players is crucial. Subscribe to our club letter for exclusive DataRobot IPO insights.

Former Expedia CFO joins Plaid

Plaid, the fintech firm, appoints former Expedia CFO Eric Hart as its first CFO. Speculation on IPO plans while diversifying revenue streams and emphasizing security in payments.

OpenAI Seeks $86 billion valuation

OpenAI's valuation soars to $86 billion, driven by AI advancements. Employee stock sale in discussion. ChatGPT's rapid growth fuels OpenAI's success in the chatbot industry.