LATEST NEWS ON PRE IPO COMPANIES

follow the news on the most interesting pre ipo companies.

EPIC Games Q1 2022 Selected News Flow

This page contains the link to a curated selection of news regarding EPIC Games in Q1 2022.

Q1 22 Valuation At Market Of Covered Names

The rules for Valuation at Market© are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to Certificates of Incorporation, Limited Offering Exemption Notices, Employee Plan Exemption Notices) and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the Fund Manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last Day of each January, April, July and October.

FLEXPORT MAKES IT INTO THE TIME100 MOST INFLUENTIAL COMPANIES OF 2022

Flexport made $3.3 billion in revenue last year amid the supply-chain crisis, up 154%. More recently, Flexport raised over $19.5 million to deliver goods for Ukrainian refugees.

Private Equity vs. Venture Capital: What’s the Difference?

VC firms typically diversify their funds across numerous startups, acknowledging that only a few will generate substantial gains. They tend to concentrate their capital on star assets and disregard 75% of their holdings, a strategy that requires exceptional talent, thus explaining why consistent top performers are few.

THE PATH TO WEALTH IS OWNING EQUITY IN US TECH PRE IPO COMPANIES.

Wealth does not come through hourly paid work.

To own a stake in a business is the only way to wealth.

The best businesses to invest in are tech companies in the U.S.

SHORT ANALYSIS ON THE Executive Order on Ensuring Responsible Development of Digital Assets.

Short Analysis on the Executive Order on Ensuring Responsible Development of Digital Assets.

RIPPLE VS. SWIFT

Comparison between the two most popular cross-border payment networks: SWIFT and RippleNet.

Who’s Making Money in Video Games? Understand the industry here:

Broadly speaking, the video game industry can be broken down into hardware manufacturers and publishers. Games can also be broken down into console, PC (personal computer) and mobile games, each of which bring their own considerations. Furthermore, some related trends like esports and streaming play off of video games.

Addepar Lands Firmwide Deal With RBC Wealth Management

Addepar, a fast-growing financial-technology provider, has reached a deal with RBC Wealth Management-U.S. to deploy its platform in its largest full-firm integration to date.

Space industry year ahead

If 2021 was the year of ostentatious displays of wealthy space tourists for chartering one-off missions, 2022 promises to be yet another year solidifying the private sector's grip on modern space travel.

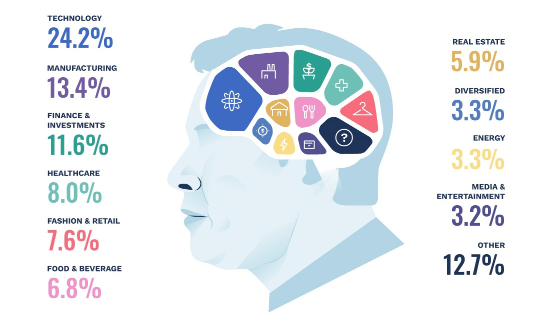

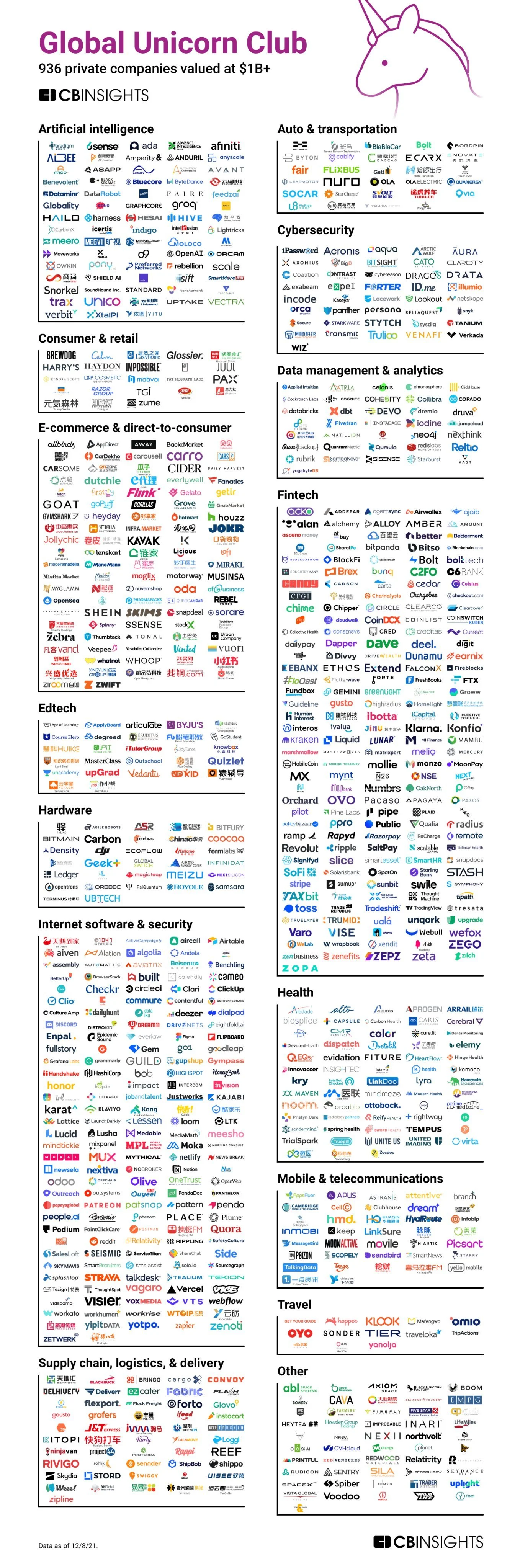

2021 global unicorn list

A unicorn company is a private company with a valuation over $1 billion. As of December 2021, there are more than 900 unicorns around the world. Get the full list with Name, Valuation, Date it joined the list, Country, Industry and Major Investors.

SoftBank-backed Automation Anywhere to acquire FortressIQ

Automation Anywhere Inc, a software company backed by SoftBank Group Corp's (9984.T) Vision Fund, has agreed to acquire cloud computing company FortressIQ, according to people familiar with the matter.

5 Potential IPOs to Watch For in 2022.

This has been a banner year for initial public offerings. In 2021 so far, they have totaled more than $301 billion collectively, much beyond 2020's record of $168 billion, according to Dealogic. Next year, tech, and particularly fintech, likely will dominate IPO activity. With venture-capital flowing freely, some of the largest private tech companies in the United States held out on predicted IPOs in 2021 because they didn't need additional cash infusions. But a different story could play out in the coming year. These are the fast-growing companies to watch that might--finally--go public in 2022.

7 Companies Likely To Go Public in 2022

Initial public offerings are often a hot topic among investors who envision getting in on the ground floor of “the next big thing.” And in many cases, IPOs do rip higher immediately after they start trading, particularly if they are for well-known, up-and-coming companies.

End of Year VALUATIONS

During the last part of the year we update our analytical monitors and charts, in order to be ready to lead syndication of deals from January next year. We thought you may be interested in a short update of where the names we follow are trading.

Addepar Lands Firmwide Deal With RBC Wealth Management

Addepar, a fast-growing financial-technology provider, has reached a deal with RBC Wealth Management-U.S. to deploy its platform.

Impossible Foods raises $500 mln

Impossible Foods has raised nearly $500 million in a funding round led by existing shareholder Mirae Asset Global Investments, highlighting a surge in investor appetite for fast-growing plant-based meat makers.

The Year Of The Decacorn: 2021 Shatters Records For Number Of New Startups Valued At $10B+

More new startups valued at $10 billion or above have been minted in 2021—far more than in any prior year, and double the number created in 2020, which set the previous record for new “decacorns,” as these highly valued companies are known.

15 Years Of BlaBlaCar

The goal is to stay independent and at some point, that means most likely you become a public company. By the back end of 2022, we should be demonstrating operating leverage that would put us in a reasonable position to IPO at that time.

IPOs and SPACs seem poised for a hot Q4, with Instacart and Rivian leading the way

The U.S. IPO and SPAC markets rolled on during Q3 at their strongest clip since at least the dot-com boom, and experts see no signs of a slowdown in Q4. They expect Instacart (ICART), Rivian (RIVN) and other hot names to either go public or at least file for IPOs or direct listings during the new quarter.