LATEST NEWS ON PRE IPO COMPANIES

follow the news on the most interesting pre ipo companies.

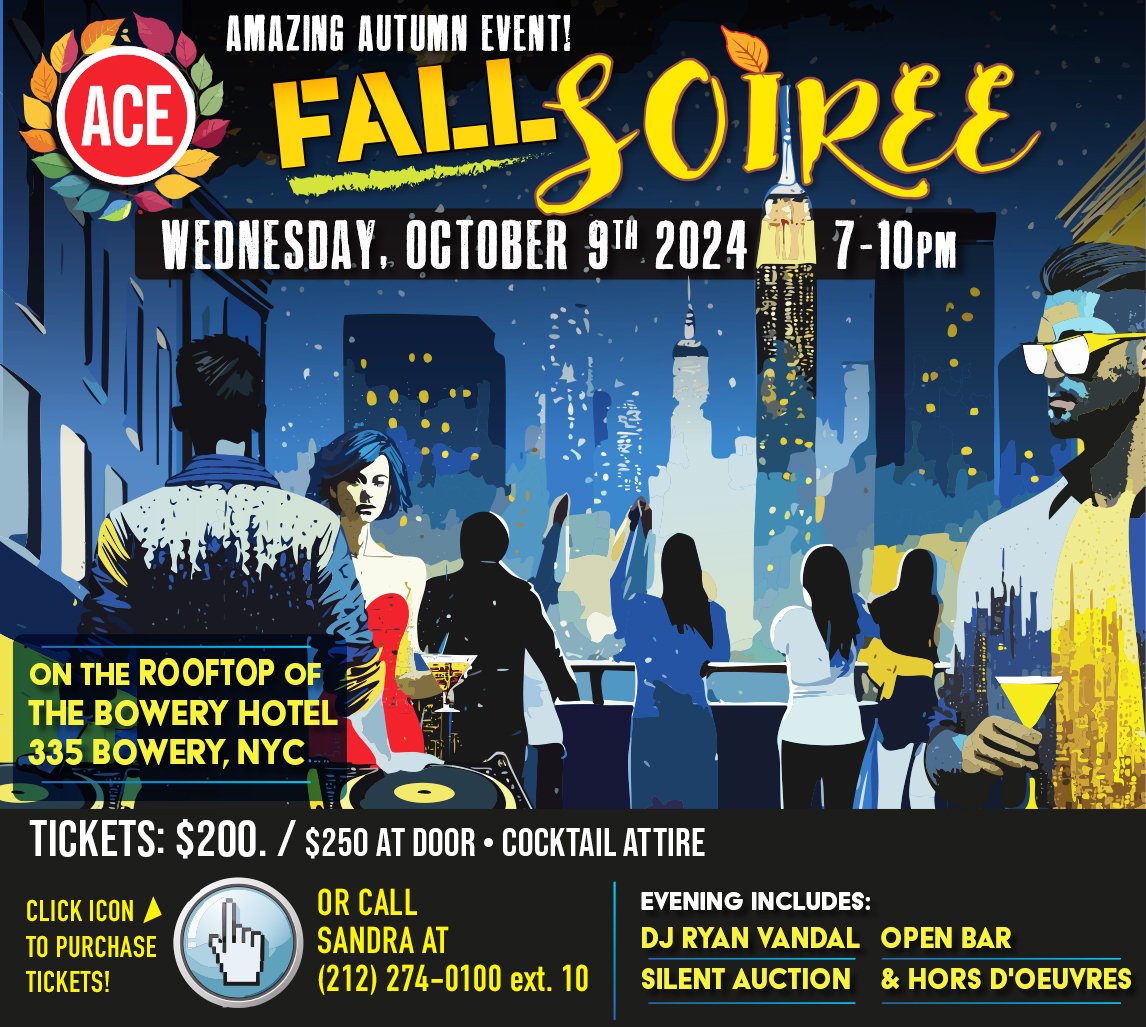

ACE fall event in NEW YORK

Join ACE’s Fall Soirée on October 9, 2024, for a chic night on The Bowery Hotel Rooftop in NYC, featuring live music, an open bar, hors d’oeuvres, and a silent auction.

#ACEFallSoirée #NYCEvents #TheBoweryHotel #Fall2024 #RooftopParty #NYCNightlife #OpenBar #DJRyanVandal #CocktailAttire

Newcleo’s Summer Milestones

Newcleo achieved major milestones this summer, expanding globally, co-hosting PHYSOR 2026, advancing nuclear technologies in Slovakia, and engaging in France's innovative reactor projects. Newcleo is also poised to support the UK's clean energy goals with the launch of Great British Energy.

#Newcleo #NuclearInnovation #SMR #AMR #France2030 #NuclearTechnology #Decarbonization #Slovakia #GreatBritishEnergy #PHYSOR2026

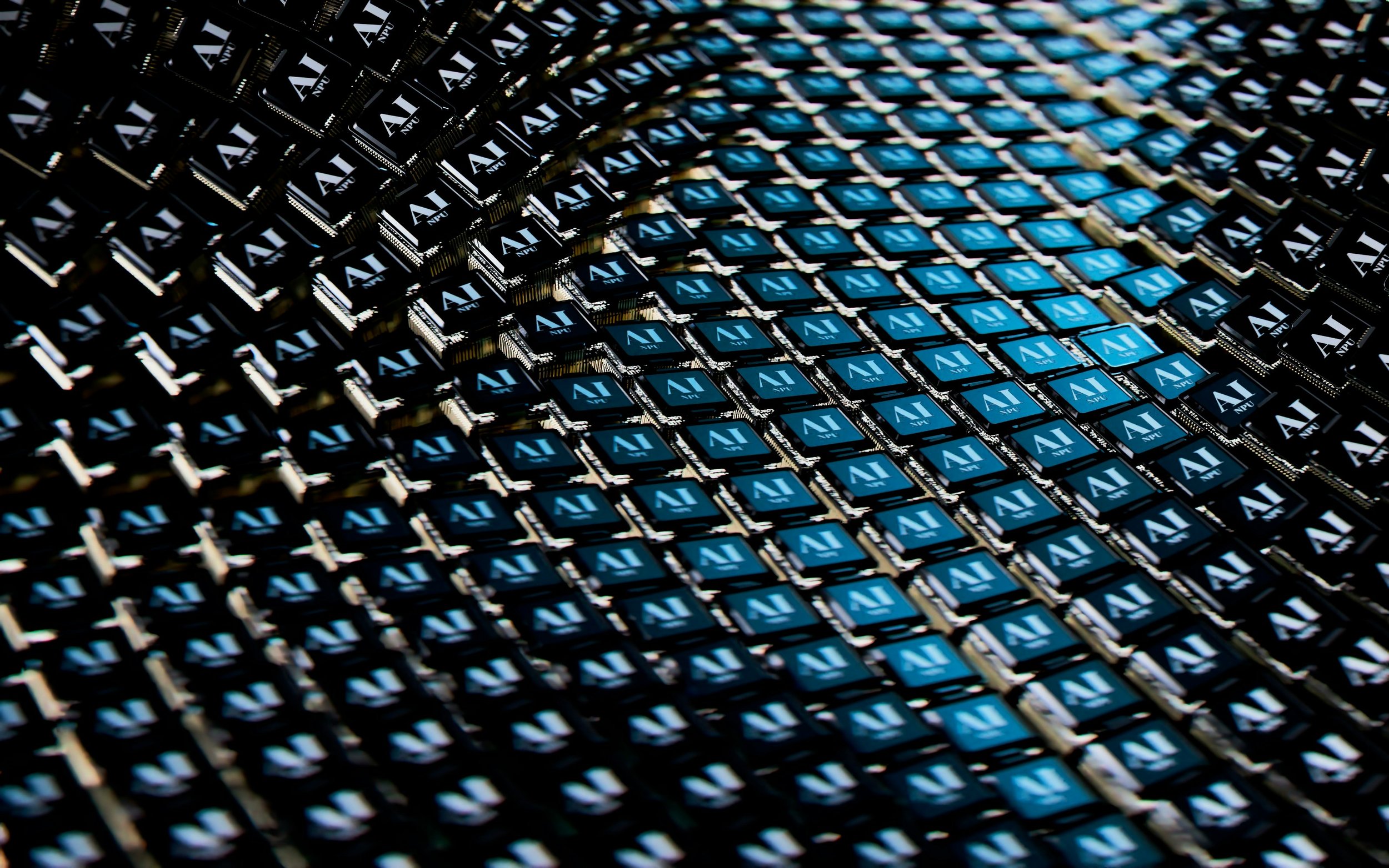

Powering the AI Revolution

As AI continues to revolutionize industries, the energy demands of training and deploying large-scale models are surging. Understanding the cost-effectiveness and sustainability of different power sources is crucial for AI data centers to manage operational costs and environmental impact.

#AI #EnergyConsumption #DataCenters #RenewableEnergy #NuclearPower #SolarEnergy #WindEnergy #Sustainability #CarbonNeutral #TechIndustry #ArtificialIntelligence

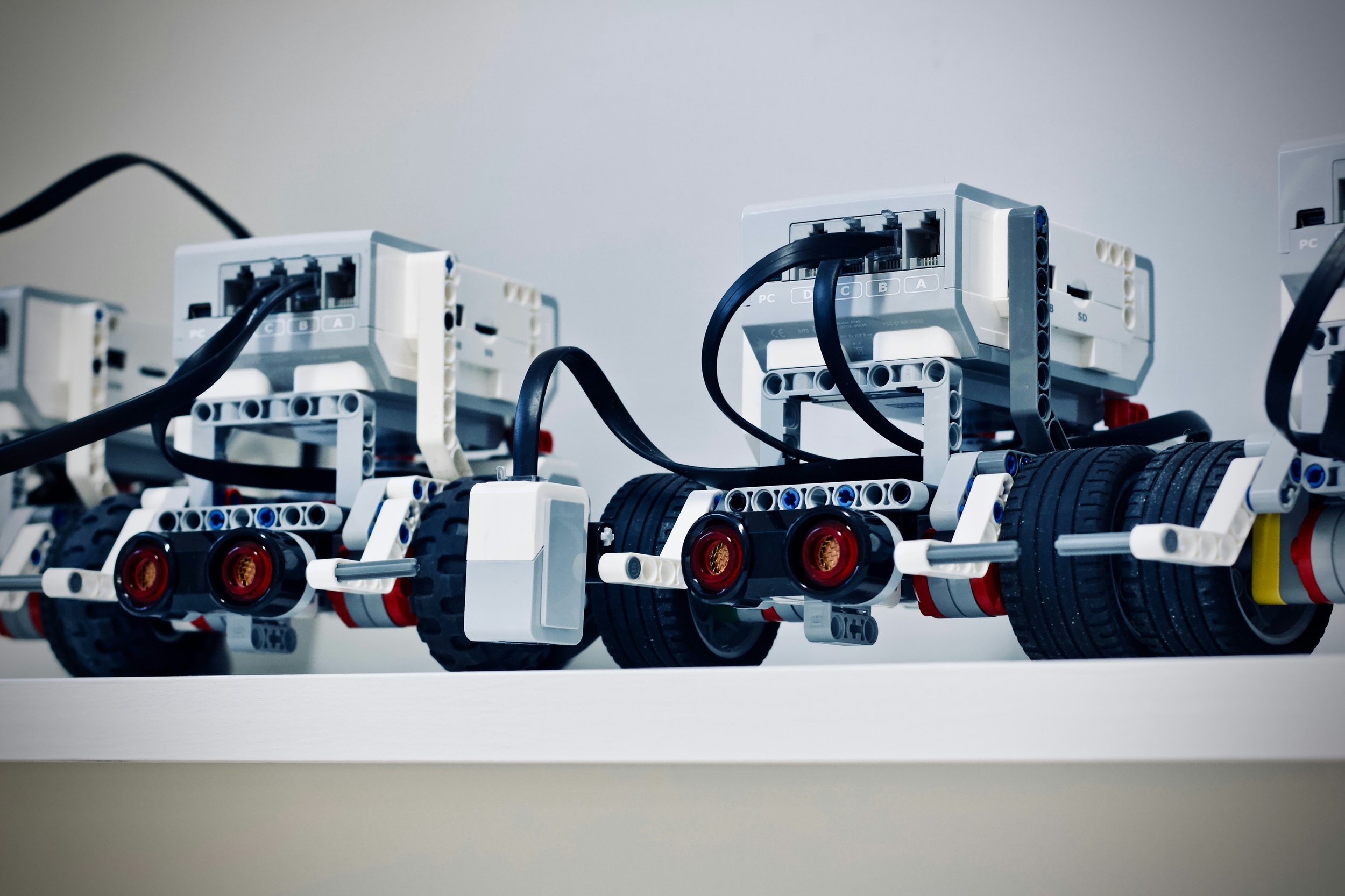

Investing in Robotics

Robotics startups have struggled commercially despite significant innovation. Challenges include high R&D costs, technical difficulties, and market saturation. While success stories like Kiva Systems exist, failures have been more common due to difficult economics, margin compression, and integration challenges.

#robotics #startups #innovation #KivaSystems #R&D #margins #commercialization #technology #automation #techindustry #investing #venturecapital #marketchallenges

VC Investment in AI

The influx of capital into AI reflects broader venture trends, demanding returns that stretch plausibility. With $125B invested annually, VCs must achieve 3x returns. Expect volatility in secondaries as supply increases and discounts become more pronounced.

#VentureCapital #AICapital #SecondaryMarkets #LimitedPartners #MarketVolatility #InvestmentReturns #VC #NetAssetValue #InvestmentStrategy

Grok-2: xAI's New Powerhouse Enters the AI Arena

Grok-2, xAI’s latest large language model, has quickly emerged as one of the top five AI models worldwide. Accessible via Musk’s platform X, Grok-2 is set to become available for developers soon, empowering enterprise applications. Despite legal battles and data privacy concerns, xAI is pushing forward, backed by a $6 billion funding round. The AI race heats up as Grok-2 challenges industry leaders like OpenAI’s GPT-4o.

Newcleo Relocates Holding Company to France

Newcleo, a UK-based nuclear start-up, is ambitiously advancing lead-cooled fast reactors (LFRs), despite being in early stages. Founded in 2021, Newcleo has rapidly formed strategic partnerships and secured significant funding, including a €1 billion equity raise. With plans to deploy its first commercial LFR in the UK by 2033, Newcleo is poised to impact the future of nuclear energy majorly.

#Newcleo #NuclearEnergy #LeadCooledReactor #SMR #LFR #MOXFuel #AdvancedNuclear #NuclearInnovation #UKNuclear #France2030 #NuclearCollaboration #CleanEnergy #Decarbonization

AI for health-tech

AI transforms healthcare by enabling early diagnosis, personalizing treatments, and accelerating drug discovery. Learn how portfolio companies DataRobot and 42Robots.ai are leading this transformation. #AI #Healthcare #MedicalResearch #DataRobot #42Robots #IPOClub

SpaceX Update: A Technical, Business, and Funding Overview

SpaceX continues to lead in space innovation with its Falcon 9 rocket and expanding Starlink network. As Starlink achieves cash-flow breakeven, investors eye SpaceX's robust growth potential amidst a significant launch backlog and strategic government partnerships.

#SpaceX #Falcon9 #Starlink #SpaceTechnology #SatelliteInternet #PrivateInvestment #GovernmentContracts #SpaceIndustry #ElonMusk #LaunchBacklog #ReusableRockets #SpaceCommunications

Ripple to Pay $125M for Improper XRP Sales.

A Manhattan court ordered Ripple Labs to pay $125 million in penalties over improper XRP sales. The SEC had initially sought $2 billion. The case, closely watched in the crypto space, ended with Ripple CEO Brad Garlinghouse acknowledging the ruling and planning for future growth.

#Ripple #XRP #Cryptocurrency #SEC #SecuritiesLaws #BradGarlinghouse #CourtRuling #CryptoRegulation #Investment #DigitalAssets

Elon Musk Proposes $5 Billion Tesla Investment in xAI

Elon Musk proposes a $5 billion Tesla investment in xAI to enhance self-driving technology, gaining strong public support and promising strategic advancements.

#ElonMusk #Tesla #xAI #SelfDriving #AutonomousVehicles #AIInvestment #GrokChatbot #AndreessenHorowitz #SequoiaCapital #OpenAI #GoogleAI

Venture Capital Thematic Investing: Risks and Pitfalls

Focusing too much on trendy investment themes in venture capital can lead to inefficiencies and suboptimal returns. The best investments often lie outside predefined theses, offering less competition and higher potential.

Venture capital, Canva, startup funding, innovation, Melanie Perkins, AirBnB, WhatsApp, SpaceX, Dropbox, investment challenges, design software, entrepreneurial success.

Musk: Texas as a Hub

Centralizing xAI, Neuralink, and SpaceX in Texas enhances collaboration and operational efficiency, accelerating Musk's vision for the future. Discover how this strategic move benefits IPO CLUB's portfolio companies.

AI is Transforming Patient Care

AI transforms healthcare by enabling continuous patient support through advanced data synthesis and communication, promising better outcomes and lower costs.

#AIinHealthcare #ArtificialIntelligence #PatientSupport #HealthcareRevolution #MedicalAI #AGI #42ROBOTS #HealthTech #Cybersecurity #DigitalHealth #HealthcareInnovation

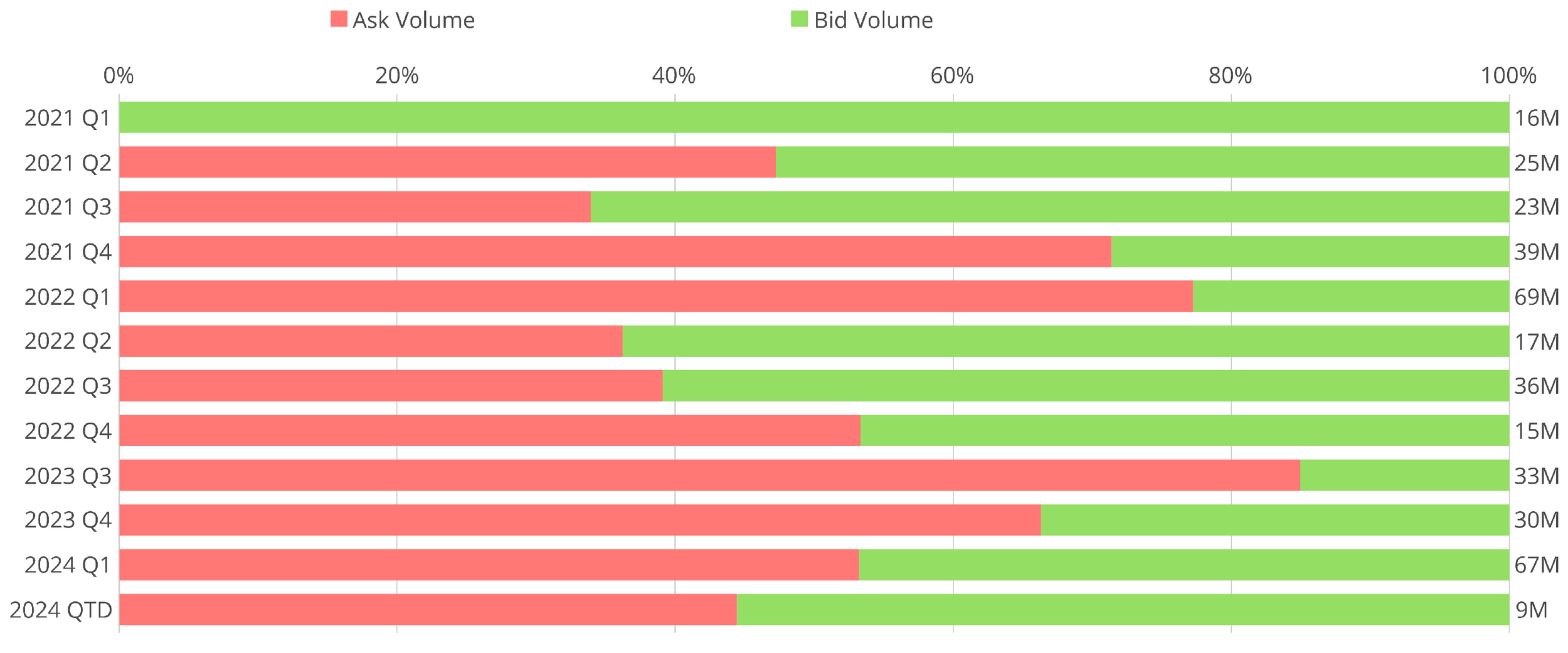

Pre-IPO stocks Q2 update

In Q2 2024, venture capital activity remains robust with heightened liquidity and stabilized trade volumes around $10M, despite a slight dip from Q1 peak levels. Significant transactions over $50M are resurfacing, indicating strong investor confidence.

#VentureCapital #Q22024 #MarketAnalysis #InvestorBehavior #TradeVolumes #Liquidity #ActiveBuyers #Investment #FinancialMarket

Anduril stock in current funding round

Anduril Industries is in the process of securing $12.5B valuation in Series F funding round led by Founders Fund and Sands Capital, emphasizing R&D and global expansion.

#Anduril #DefenseTech #VentureCapital #Funding #TechInvestment #AndurilStock #DefenseTechGrowth #InvestmentTrends #MarketAnalysis

How to become an accredited investor

How to become an accredited investor?

An accredited investor is an individual or institution that has earned special status to invest in unregulated securities such as pre-IPO and venture funds.

To qualify as an accredited investor, you must meet certain qualifications, such as being a high earner or having a net worth of $1 million.

Unregistered securities are inherently risky but often offer higher rates of return, allowing accredited investors to build wealth quickly.

Kraken Eyes Funding Round Ahead of possible IPO

Kraken is eyeing a $100M funding round ahead of a potential IPO amid Bitcoin's surge above $73,000. It plans to launch a public offering next year.

Kraken, IPO, Bitcoin, crypto exchange, funding round, SEC, regulatory challenges, cryptocurrency, digital assets, investment.

#Kraken #IPO #Bitcoin #CryptoExchange #FundingRound #SEC #Cryptocurrency #DigitalAssets #Investment

Northvolt: Pioneering Europe's Battery Revolution and Eyeing IPO

Northvolt, a Swedish battery manufacturer founded by former Tesla executives, is rapidly expanding in Europe and North America. With over $9 billion raised and significant partnerships with major automakers, Northvolt is poised for a major IPO within the next two years. Explore the company's history, growth, and future prospects in this detailed analysis.

#Northvolt #IPO #LithiumIonBatteries #RenewableEnergy #ElectricVehicles #SustainableInvesting #GreenTech #BatteryManufacturing #Europe #TeslaExecutives #Stockholm #Skellefteå #Investment #VentureCapital #BlackRock #Volkswagen #BMW #Volvo #Polestar

Addepar stock update, Q2 2024

Apevue recently reported the bid-offer ratio for Addepar, showing an increasing interest in the name on the bid side and increasing trading volume on the stock.

Growth, depressed valuation, and trading volume will increase Addepar’s stock price before year-end. We should see the stock price return at least to the level of the last primary round in December 2021, which was $2.65 ($2.1B valuation). #Addepar #Fintech #InvestmentManagement #WealthManagement #FinancialAdvisors #PortfolioAnalysis #PrivateBanks #FamilyOffices #DataAggregation #FinancialTechnology #ClientBase #RIA #InvestmentAdvisors