LATEST NEWS ON PRE IPO COMPANIES

follow the news on the most interesting pre ipo companies.

Rubrik ARR hits half a billion – IPO ahead?

Rubrik has reached annual recurring sales of $500 million and added Qualcomm chairman Mark McLaughlin to its board. Is that an IPO we’re smelling?

Rubrik is notable not least because it has raised an astonishing $552 million in funding since it was founded in 2014, but because it started out doing data protection and now cybersecurity is its main product focus.

AN COMPARISON BETWEEN DATAROBOT AND OPENAI, WRITTEN BY CHATGPT

OpenAI and DataRobot are two companies that are at the forefront of the artificial intelligence and machine learning industry.

OpenAI and DataRobot are two leading companies in the field of artificial intelligence (AI) and machine learning (ML).

5 TIPS NOT TO SUCK AT THIS GAME.

We publish 5 tips on how to succeed at the game of generating extra returns. These rules, in our opinion, apply to both long-term investors looking to outperform benchmarks.

Anduril and the U.S. National Security and Defense Market

The US government will spend $858,000,000,000 on defense in 2023. $34 billion, or 4%, will go to startups for early-stage research and development.

Multiple on Invested Capital (or “MOIC”) in Venture Capital

Multiple On Invested Capital (or “MOIC”) allows investors to measure how much value an investment has generated. MOIC is a gross metric, meaning that it is calculated before fees and carry. It can be used to measure the performance of both realized and unrealized investments. It can be calculated at the deal or portfolio level.

Stripe cuts valuation by 11%

According to tech website The Information, Stripe has decreased its internal valuation a third time since last summer, this time by 11% to $63 billion.

Microsoft plans to invest $10 billion in creator of ChatGPT

Microsoft is set to invest $10 billion in OpenAI as part of a funding round that would value the company at $29 billion.

Microsoft will reportedly get a 75% share of OpenAI’s profits until it makes back the money on its investment, after which the company would assume a 49% stake in OpenAI.

A bet on ChatGPT could help Microsoft boost its efforts in web search, a market dominated by Google.

OpenAI will soon test a paid version of ChatGPT

OpenAI has shared a waitlist for a experimental ChatGPT Professional service that, for a fee, would effectively remove the limits on the popular chatbot.

OpenAI begins piloting ChatGPT Professional

OpenAI this week signaled it’ll soon begin charging for ChatGPT, its viral AI-powered chatbot that can write essays, emails, poems and even computer code.

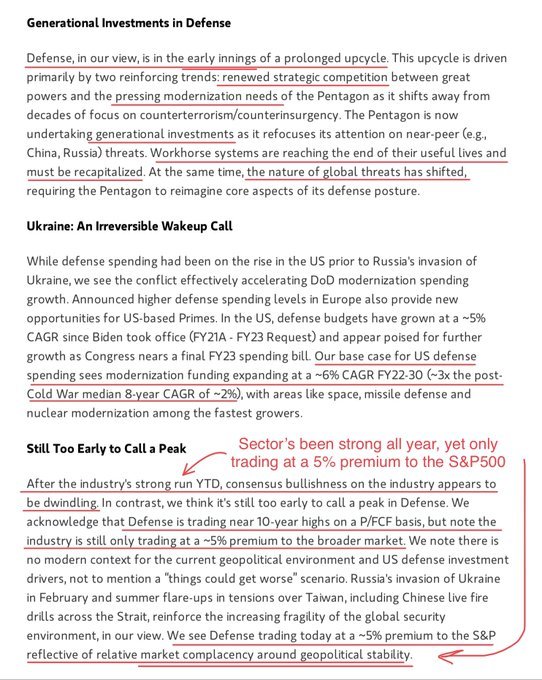

Defense stocks bull super cycle is here.

Morgan Stanley on the “early innings in the prolonged Defence upcycle”. Two key reasons: renewed strategic competition (away from two decades of fighting “terrorism”, to Russia/China), and a need to modernise workhorse systems that are reaching the end of their useful lives.

A quick look at 2023 exits

2022 was a rocky year for IPOs. In the US, the only market we care about, the number of IPOs fell by 76% and proceeds down 95%. And look at the Renaissance ETF IPOs, it's down more than 50% over the last year.

ANDURIL AUTONOMOUS SUB DOCKS IN SYDNEY

The stealthy extra-large autonomous undersea vehicle program (XL-AUV) being developed by Anduril Australia has been formally named the “Ghost Shark” by the Department of Defense in a ceremony in Sydney.

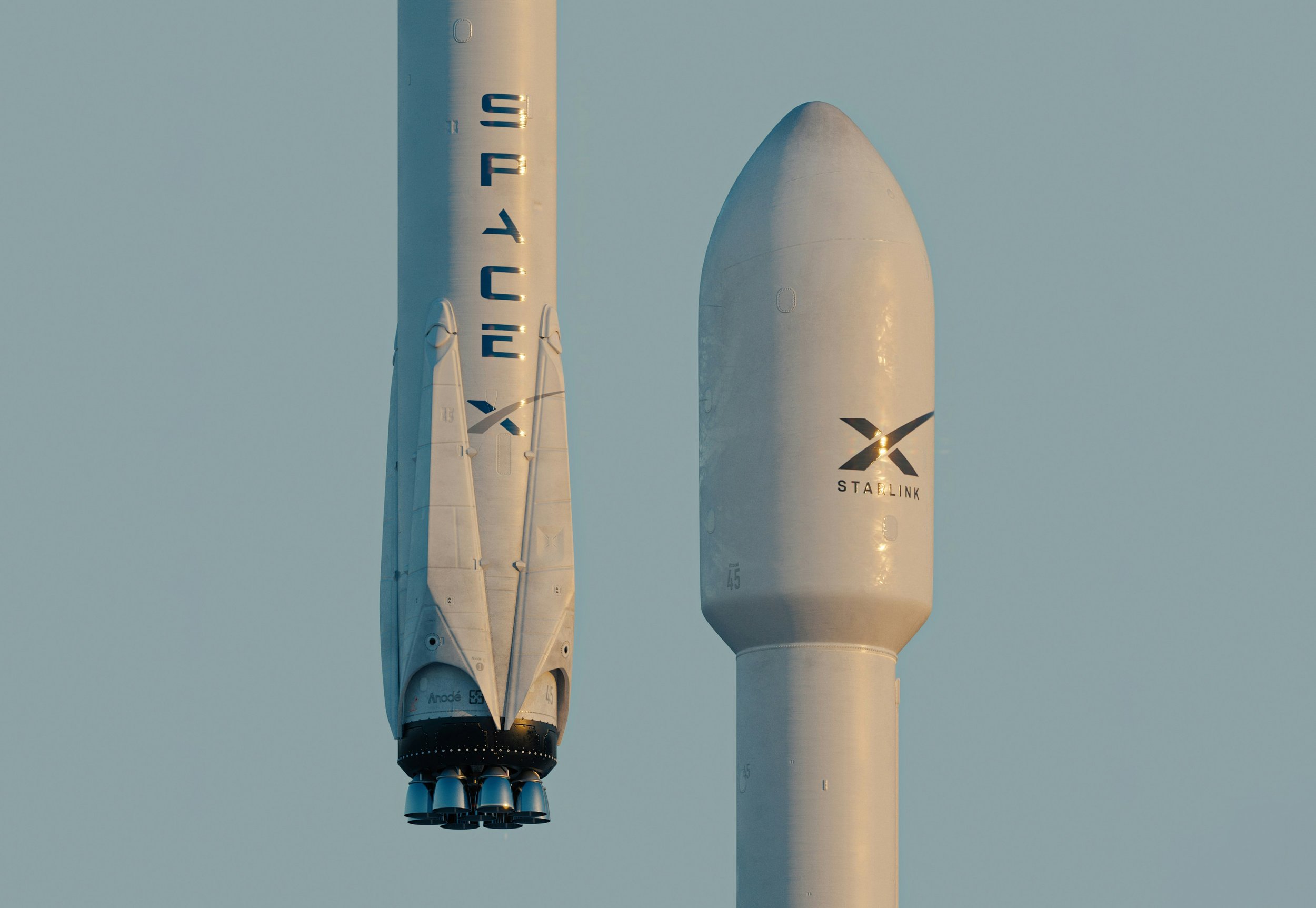

SpaceX Valued at $137 Billion in Latest Funding Round

Space Exploration Technologies Corp. is raising $750 million in new fundraising, which values the company at $137 billion.

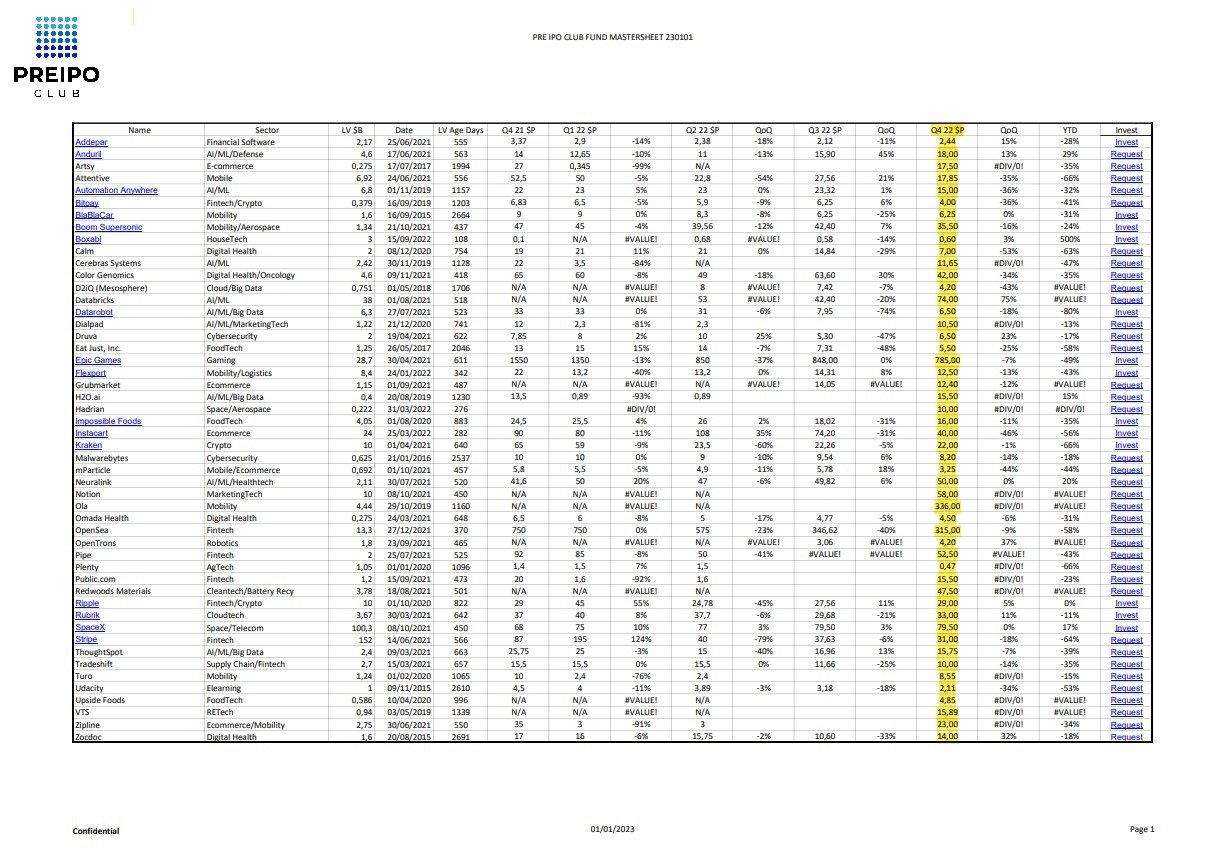

Q4 22 Valuation At Market

The rules for “Valuation at Market©” are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to certificates of incorporation, limited offering exemption notices, employee plan exemption notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last day of January, April, July, and October.

SpaceX sets a new record by reusing its F9 booster for the 15th launcH

SpaceX sets a new record by reusing its F9 booster for the 15th launch. It has been an honor to fund this project with so many talented company managers and employees, as well as one crazy CEO.

PRE IPO CLUB ROADSHOW FOR SOSTRAVEL.COM update

Thank you to all the people who attended the U.S. Roadshow sponsored by SosTravel.com, which started trading on the OTCQB last week; we already met with 20 potential investors in the United States and will head back early next year, armed with the new five-year business plan for 2027.

Ripple v. SEC court case update as of December ‘22

Despite the rumors that the final judgment on the case might be ready by December 15, as both the regulator and the blockchain company have filed their amici briefs and final submissions, in an indication that the conclusion might be close, the date has come and gone without it.

BOXABL VISIT AND UPDATE.

Today it was a good day, I visited Boxabl in North Vegas, NV, for the first time.

APP my RIA

A platform created by a company named Addepar is an automation solution that can provide the required integration of all the tasks required to assist clients in their financial management.

Investment advisers need to work more efficiently, more quickly, and more intelligently. This is the case whether they are dealing with listed equities, bonds, or alternative assets, such as private investments, digital currencies, and art.

PRE IPO CLUB ROADSHOW FOR SOSTRAVEL.COM

Join us for a series of exclusive event sponsored by SosTravel.com