LATEST NEWS ON PRE IPO COMPANIES

Follow the news on the most interesting pre ipo companies.

The U.S.-China AI Race: An Ecosystem Problem, Not Just a Technology Gap

We discuss two key sectors of the America 2030 fund that are connected with China.

China’s rapid industrialization is not just about manufacturing dominance—it’s about building an entire ecosystem that supports AI, from infrastructure to energy. With six times the U.S.‘s electrical grid expansion in 2023 alone, China is laying the foundation to dominate AI. This isn’t just a technology race; it’s a systemic shift.

2000 Years of Defense Spending

Explore 2000 years of defense spending trends, from ancient empires like the Song Dynasty and Roman Empire to modern post-WWII nations. This analysis reveals how military priorities have shaped economies and geopolitical strategies.

Betting on America Is the Winning Strategy for Investors

The U.S. stock market, driven by "animal spirits" and S&P 500 global exposure, remains the ultimate investment choice. Learn why historical data and expert insights, including Stanley Druckenmiller's comments, reinforce America's consistent market dominance.

#USMarkets #SP500 #Investing #StanleyDruckenmiller #AnimalSpirits #VanguardData #StockMarketPerformance #GlobalExposure #DollarStrength #JohnBogle #AmericanEconomy #InvestorProtections #StableRegulation #EmergingMarkets #MarketAnalysis

In Plain Sight, No Longer Invisible: Europe at a Crossroad

Europe's reliance on external powers for security, energy, and trade is unraveling, exposing vulnerabilities. IPO CLUB highlights investment opportunities in defense (Natilus) and energy (Newcleo) as critical to bridging the gap with global power blocs.

Automation and Technology Transforming Modern Warfare: The Future of Defense

Exploring the dual-use potential of AI models like Grok, ChatGPT, and Gemini in defense: from real-time data analysis and intelligence gathering to training simulations, each AI offers unique capabilities that could enhance military operations if adapted with ethical safeguards.

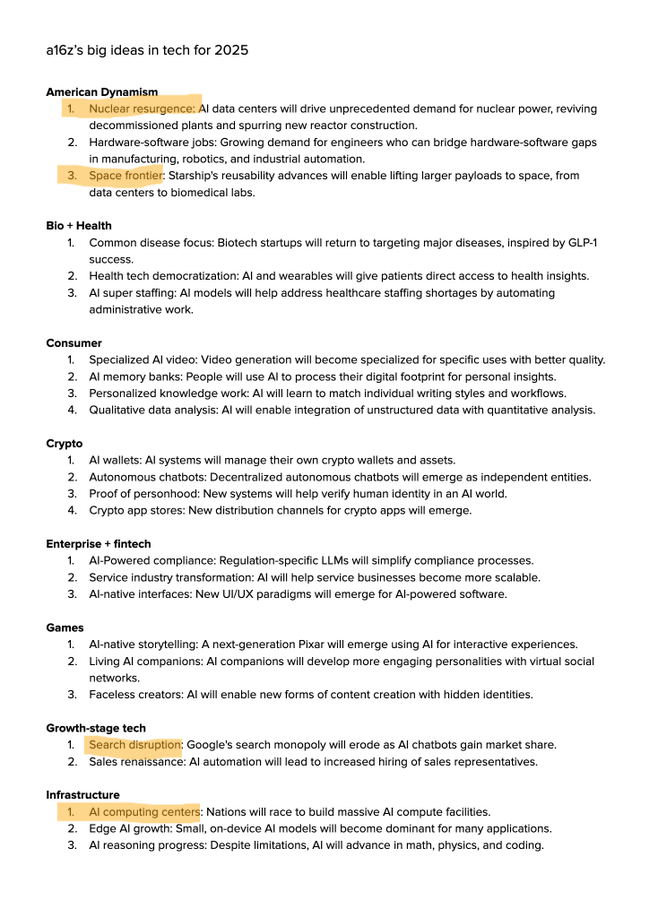

Trend Is Your Friend: Tech’s Biggest Ideas for 2025

AMERICA2030’s portfolio reflects a commitment to shaping the future through investments in critical technologies. From nuclear energy and reusable rockets to AI-disrupting search and custom computing hardware, we provide unparalleled exposure to the technologies driving America’s industrial renewal.

Think Outside the Boxes: Rethinking the VC Playbook for AI Investment

Most VC firms invest in the same well-trodden paths of the AI value chain, from applications to hardware. But IPO CLUB sees opportunity in the overlooked fundamentals — electricity, data, communication infrastructure, and more. Learn why thinking outside the boxes drives better returns.

Trump’s Policies Impact on selected US growth companies

Donald's Honeymoon.

With Donald Trump’s election as President of the United States, there is significant anticipation about how his proposed policies—spanning #deregulation, #tax#reforms, and international #trade—might reshape certain industries and the #leading#growth#startups in #America.

We have divided selected portfolio companies into three groups: Strongly Positive, Positive and Somewhat Positive.

US tech wins the elections

Donald Trump’s recent re-election promises a favorable climate for U.S. late-stage tech startups, with policies on deregulation, tax incentives, reshoring, and emerging technologies driving potential growth. Enhanced government partnerships, particularly in AI and aerospace, are expected to bolster opportunities for venture-backed companies poised for expansion.

Key Geopolitical Risks Driving Global Defense, Energy, and Security Investments

Geopolitical tensions are reshaping global defense, energy, and security sectors, with increased military budgets in Europe, regional conflicts in the Middle East, and rising defense spending in the Asia-Pacific. From cybersecurity threats to energy security challenges, these risks highlight critical investment opportunities across defense technology, renewable energy, and cybersecurity.

Natilus Unveils Horizon: A 200-Seat Blended-Wing-Body Aircraft for Sustainable Long-Haul Aviation

Natilus launches Horizon, a 200-seat Blended-Wing-Body aircraft offering 30% fuel savings and 40% increased cabin space. Designed to support airlines’ 2050 emissions targets, Horizon aligns with fleet renewal cycles, offering a sustainable, efficient solution for long-haul aviation.

#Natilus #BlendedWingBody #SustainableAviation #HorizonAircraft #FuelEfficiency #ZeroEmissions #LongHaulFlights #AerospaceInnovation #Boeing737 #Airbus320 #ZeroAvia #GreenAviation #FutureOfTravel

AI and the Railway Mania: Lessons from History’s Investment Bubbles

The AI investment frenzy, exemplified by OpenAI's recent $157 billion valuation, mirrors past bubbles like the 19th-century railway boom. Investors are drawn in by revolutionary potential, but history teaches us that overestimating demand, speculative behavior, and lack of regulation can lead to failure. To succeed, investors must focus on fundamentals and long-term viability.

Mario Draghi’s report And Unlocking Europe’s Venture Capital Potential

Europe’s venture capital market faces critical challenges, from fragmented markets to underdeveloped capital ecosystems. With only 5% of global VC funding, European startups often relocate to the U.S. for better access to capital. IPO Club’s experience reflects these dynamics, highlighting the need for market reforms to retain innovation, talent, and funding within Europe.

#VentureCapital #EuropeanStartups #TechInnovation #CapitalMarkets #InvestmentStrategy #ScalingInnovation #MarioDraghi #StartupEcosystem #PrivateEquity #USInvestments #GlobalEconomy #Entrepreneurship #FinancialMarkets

ACE fall event in NEW YORK

Join ACE’s Fall Soirée on October 9, 2024, for a chic night on The Bowery Hotel Rooftop in NYC, featuring live music, an open bar, hors d’oeuvres, and a silent auction.

#ACEFallSoirée #NYCEvents #TheBoweryHotel #Fall2024 #RooftopParty #NYCNightlife #OpenBar #DJRyanVandal #CocktailAttire

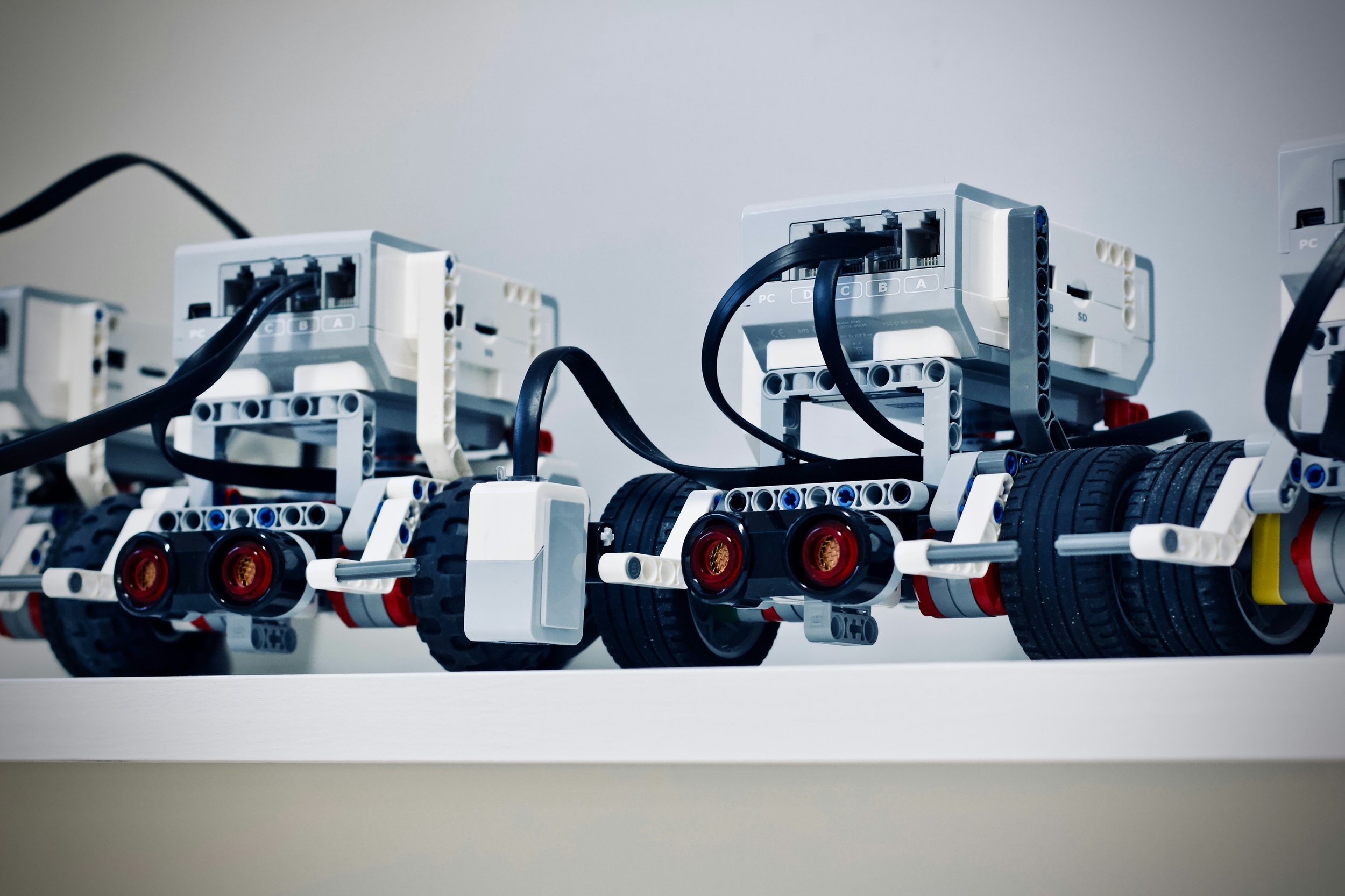

Investing in Robotics

Robotics startups have struggled commercially despite significant innovation. Challenges include high R&D costs, technical difficulties, and market saturation. While success stories like Kiva Systems exist, failures have been more common due to difficult economics, margin compression, and integration challenges.

#robotics #startups #innovation #KivaSystems #R&D #margins #commercialization #technology #automation #techindustry #investing #venturecapital #marketchallenges

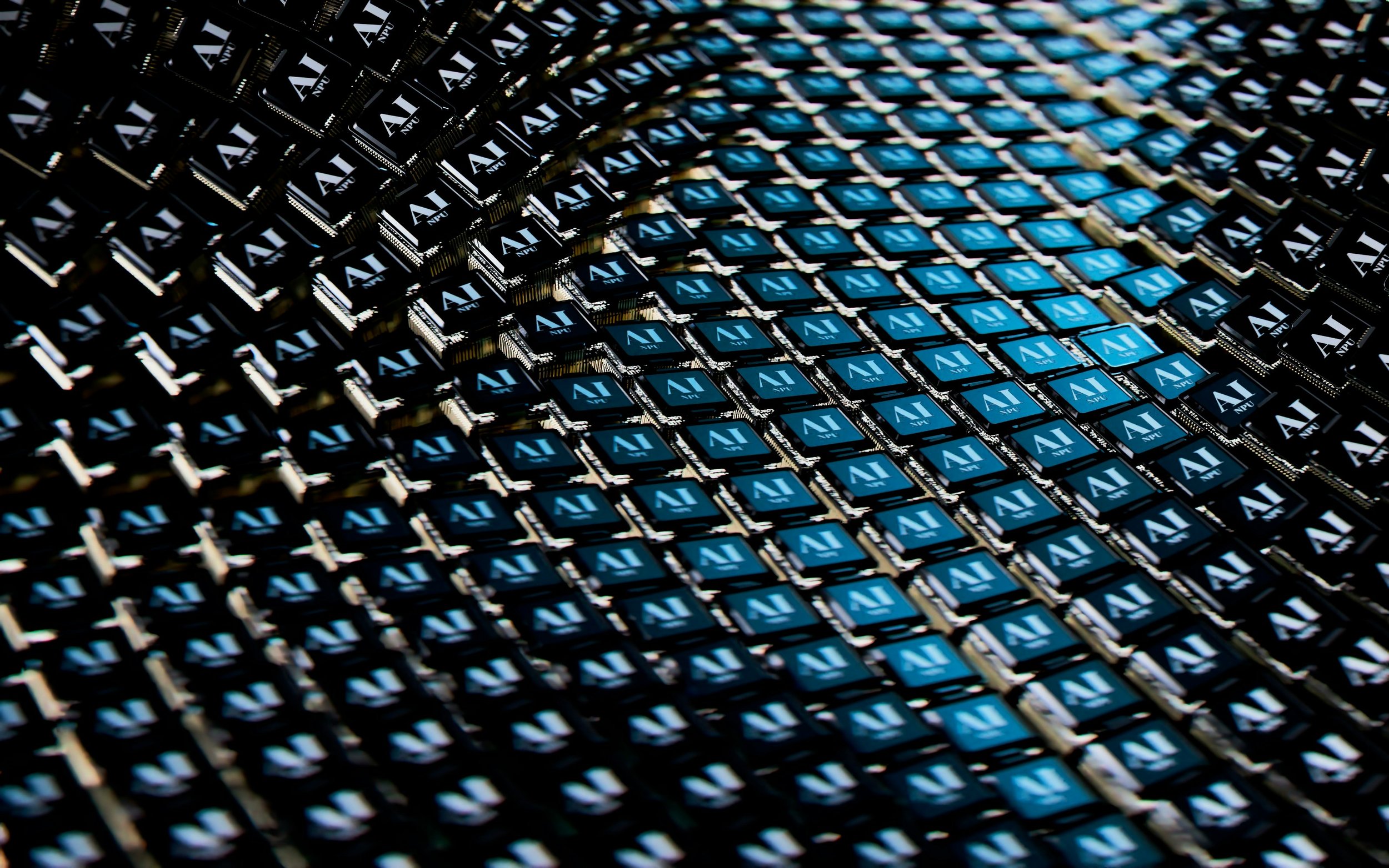

VC Investment in AI

The influx of capital into AI reflects broader venture trends, demanding returns that stretch plausibility. With $125B invested annually, VCs must achieve 3x returns. Expect volatility in secondaries as supply increases and discounts become more pronounced.

#VentureCapital #AICapital #SecondaryMarkets #LimitedPartners #MarketVolatility #InvestmentReturns #VC #NetAssetValue #InvestmentStrategy

Venture Capital Thematic Investing: Risks and Pitfalls

Focusing too much on trendy investment themes in venture capital can lead to inefficiencies and suboptimal returns. The best investments often lie outside predefined theses, offering less competition and higher potential.

Venture capital, Canva, startup funding, innovation, Melanie Perkins, AirBnB, WhatsApp, SpaceX, Dropbox, investment challenges, design software, entrepreneurial success.

Pre-IPO stocks Q2 update

In Q2 2024, venture capital activity remains robust with heightened liquidity and stabilized trade volumes around $10M, despite a slight dip from Q1 peak levels. Significant transactions over $50M are resurfacing, indicating strong investor confidence.

#VentureCapital #Q22024 #MarketAnalysis #InvestorBehavior #TradeVolumes #Liquidity #ActiveBuyers #Investment #FinancialMarket

Private Markets Q2 Report (so far)

Upcoming IPOs to watch in 2024 include Databricks, Cerebras, Circle, Klarna, Skims, Monzo, and Fanatics. These companies are set to impact the tech and fintech sectors significantly.

#IPO #PreIPO #Databricks #Cerebras #Circle #Klarna #Skims #Monzo #Fanatics #TechIPO #Fintech #Investment #StockMarket

Why We Love Venture Capital

Venture capital offers unmatched excitement and opportunities by investing in early-stage companies. Understanding psychology, corporate culture, and macroeconomic trends is crucial for navigating this dynamic field.

Keywords: #VentureCapital #InvestmentStrategy #CorporateCulture #Macroeconomics #InterestRates #Inflation #ContrarianInvesting #Agility #LongTermVision