LATEST NEWS ON PRE IPO COMPANIES

Follow the news on the most interesting pre ipo companies.

Applying Philip Fisher's 15-Point Checklist to private equity financing.

Explore Philip Fisher's 15-point checklist tailored for private stock investment. Dive into the nuances of assessing management integrity, R&D effectiveness, profit outlook, and more in private firms. Harness insights to gauge the growth potential, financial prudence, and ethical stance of private companies. Uncover how to navigate limited information and optimize investment decisions in the private sector.

FORBES Cloud 100 crowns five ipo club’s portfolio companies

IPO CLUB boasts impressive rankings in the Forbes Cloud 100, highlighting the exceptional caliber of the Club's portfolio companies.

The Millionaire Next Door: The Surprising Secrets of America's Wealthy

Discover the power of living below one's means for wealth accumulation, through this article inspired by The Millionaire Next Door: The Surprising Secrets of America's Wealthy, a 1998 book by Thomas J. Stanley.

Dive deep into the benefits of investing in private companies, from leveraging compounding and gaining higher potential returns to active involvement and diversification from traditional markets.

While a lot has changed in the last 25 years, the book offers a good set of advice on wealth generation and management.

Is Now a Good Time to Invest in Private Companies?

Investing in private companies is becoming an attractive option due to lower valuations, diversification opportunities, access to innovation, the potential for high returns, regulatory advancements, and strategic alignment with personal values. While risks like limited liquidity exist, current market dynamics present a compelling case for considering this investment avenue, with the guidance of professional financial advisors. This article explores why now might be a favorable time for investing in private companies.

What is a 401k?

Understanding 401k can be a crucial step towards effective retirement planning and long-term financial stability. This article is designed to explain the basics of 401k and delve into some specifics that can help potential investors in pre-IPO stocks decide how to allocate their contributions towards interesting private companies. It's important to note that this guide is not providing tax or financial advice but is instead a resource to better comprehend your options.

Understanding the Triad of Investing: Stake, Odds, and Prize

For those of us with our sights set on financial growth and prosperity, the investing world never truly goes on vacation. This brings to mind an intriguing parallel between two seemingly distinct activities: investing and gambling. Both fields revolve around three core elements - stake, odds, and prize.

Q2 23 Valuation At Market

The rules for “Valuation at Market©” are based on the IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to certificates of incorporation, limited offering exemption notices, employee plan exemption notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last day of January, April, July, and October.

Seizing Investment Opportunities in the IPO Market: Valuations Trailing Public Market by 30%

In a significant development that echoes the reinvigoration of the IPO landscape, the U.S. IPO market has sprung back to life with the advent of three highly anticipated listings.

Basic Human Needs and Their Impact on private market IPO investing

In light of the profound link between basic human needs and private investing, platforms that adopt this approach stand out as strategic tools for informed investing. One such distinguished platform is IPO.Club. The platform uniquely structures its investment strategies around Maslow's Hierarchy of Needs, giving its users an edge in the private market.

U.S. Recession Update: Assessing the Impact on the Private Market

In a recent interview, renowned investor Stanley Druckenmiller shared his insights on the current economic landscape and the potential for a U.S. recession. With the private market being a key area of interest for investors, we delve into Druckenmiller's observations and their implications for this sector. Let's explore the factors at play and their potential impact on private market dynamics.

Q1 23 Valuation At Market

The rules for “Valuation at Market©” are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to certificates of incorporation, limited offering exemption notices, employee plan exemption notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last day of January, April, July, and October.

Kraken outlines the exchange’s focus amid downturn

Kraken, the leading cryptocurrency exchange, has recently undergone a period of downsizing with a 30% reduction in its global workforce and the closure of its operations in Japan at the end of last year. Despite the current challenging market conditions, the company remains optimistic about its future.

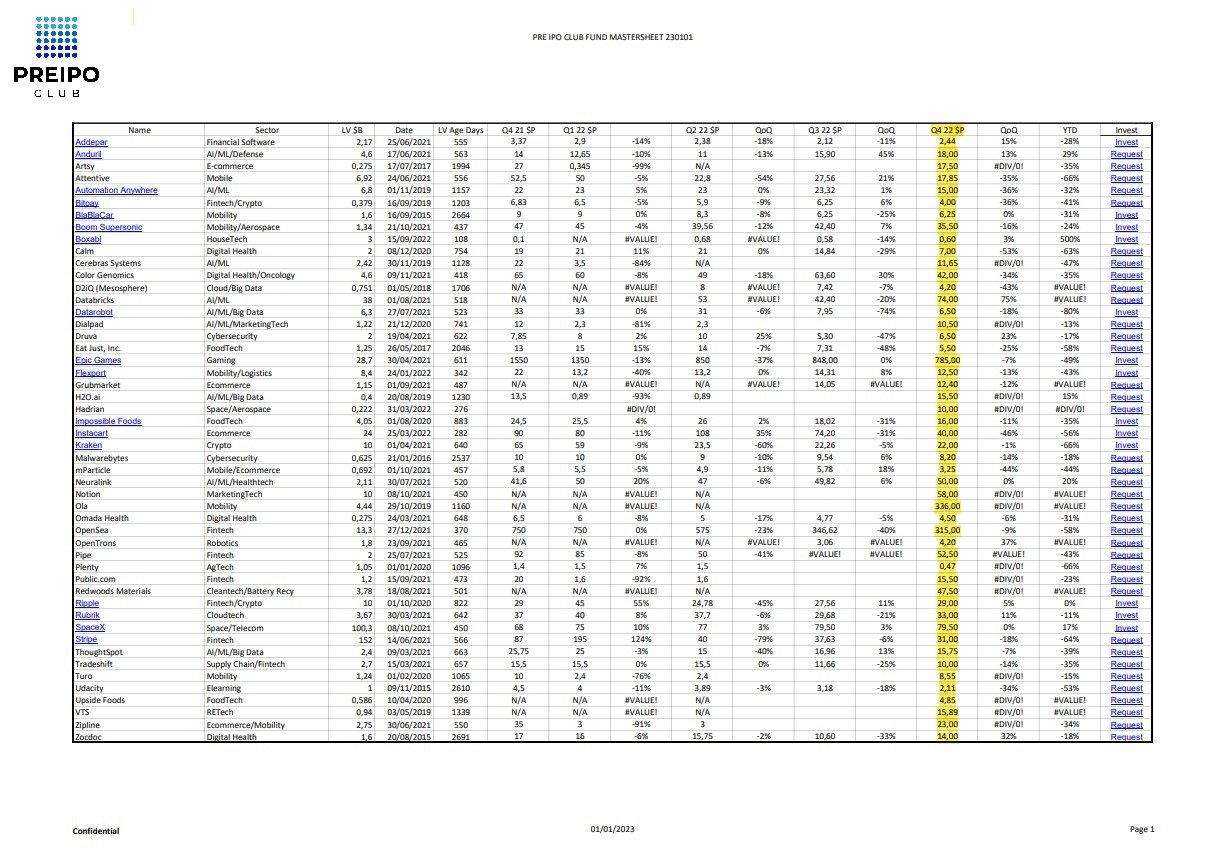

Q4 22 Valuation At Market

The rules for “Valuation at Market©” are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to certificates of incorporation, limited offering exemption notices, employee plan exemption notices), and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the fund manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs, are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last day of January, April, July, and October.

Saving and investing in ipos via dollar-cost averaging and compounding.

What is the sure path to wealth? Saving regularly, in an automated way, and keeping the money in a fast-growing asset class like private equity until IPO, taking advantage of dollar-cost averaging and compounding

Here is an article to help you do just that.

A Short Q3 IPO MARKET UPDATE

1073 companies IPO’d in 2021 in the U.S. alone, according to FactSet data, raising $317 billion.

But the sharp drop in growth stocks valuations and indices brought those deals down, and now, it is estimated that over 66% of the companies that went public in 2021 are trading below IPOs price.

Private Company Secondaries Outperform Public Peers in September

ApeVue data show that private companies weathered September

Stocks of private companies far outpaced public equity peers last month, according to ApeVue, the first independent, daily pricing data service for unicorn stocks. Amid a weak year in public markets, the 50 most active private companies in the institutional market, including well known brands like Stripe, Impossible Foods and Klarna, lost 30.61% for investors up until October 1st.

Q3 22 Valuation At Market

The rules for Valuation at Market© are based on the PRE IPO CLUB LLC proprietary methodology: price inputs are derived from the 10 most active secondary brokers during the quarter, as well as publicly available information, such as federal filings (e.g., Form D), state filings (e.g., amendments to Certificates of Incorporation, Limited Offering Exemption Notices, Employee Plan Exemption Notices) and company disclosures (e.g., press releases, other public statements). The calculation model is based on actual or derived prices of preferred stock and common stock, which are validated by the Fund Manager. Corporate actions, such as bankruptcies, stock splits, reorganizations, mergers and acquisitions, and spinoffs are monitored on a daily basis. Index values are calculated for each calendar month, but distributed on a quarterly basis, before the last Day of each January, April, July and October.

Kraken is going after smaller, retail crypto traders, says The “Talented Mr. Ripley.”

The Information has spoken to Kraken’s new CEO David Ripley, just after he took the helm, getting promoted from COO, following the 12 years reign of Jesse Powell.

Kraken VS. Coinbase

Independent pricing data provided by ApeVue shows that Kraken shares are trading around $40 in the secondary market, implying a valuation close to $10 billion instead of the $5.65 billion our model suggest.