Latest Trends on Pre IPO Companies

News on portfolio companies and sectors we cover

AI Meteoric Rise in Frontier Technologies

The global AI market is set to surge from $189 billion in 2023 to $4.8 trillion by 2033, driving growth equity investment and reshaping frontier technologies. AI’s market share will jump from 7% to 29%, outpacing IoT, blockchain, and electric vehicles. Discover key trends and growth equity opportunities in AI’s trillion-dollar future.

Robotics Companies: Market Leaders, Emerging Technologies, and Investment Opportunities

Robotics Companies are experiencing unprecedented growth, with the market projected to reach $178.63 billion by 2030, representing a 12.17% CAGR. The sector is being driven by AI integration, labor shortages, and technological breakthroughs in humanoid and autonomous robotics. This report examines key market segments, leading companies, and emerging private players positioned to capture significant market share.

Where Defense, Energy, Cyber and AI-Infra Sectors Converge

Discover why the next generation of transformative startups won’t fit neatly into a single sector. At America 2030 Fund, we invest where defense, AI, energy, and cybersecurity converge—unlocking the compounding value of dual-use technologies. Learn how companies like Crusoe and Shield AI exemplify this crossover strategy in hardtech.

18 Uprounds, 1 Listing, over $7 billion of fresh capital: Why AMERICA 2030’s Strategy Is Delivering Results

In just over a quarter into 2025, AMERICA 2030 has witnessed a remarkable confirmation of its investment thesis: 18 companies in our deal pipeline have already raised follow-on rounds at higher valuations, and Kodiak Robotics just announced a public listing via SPAC. This rapid validation highlights that we are picking the right companies at the right time—positioned at the intersection of defense, energy, security, and AI—at attractive secondary prices before broader capital catches up.

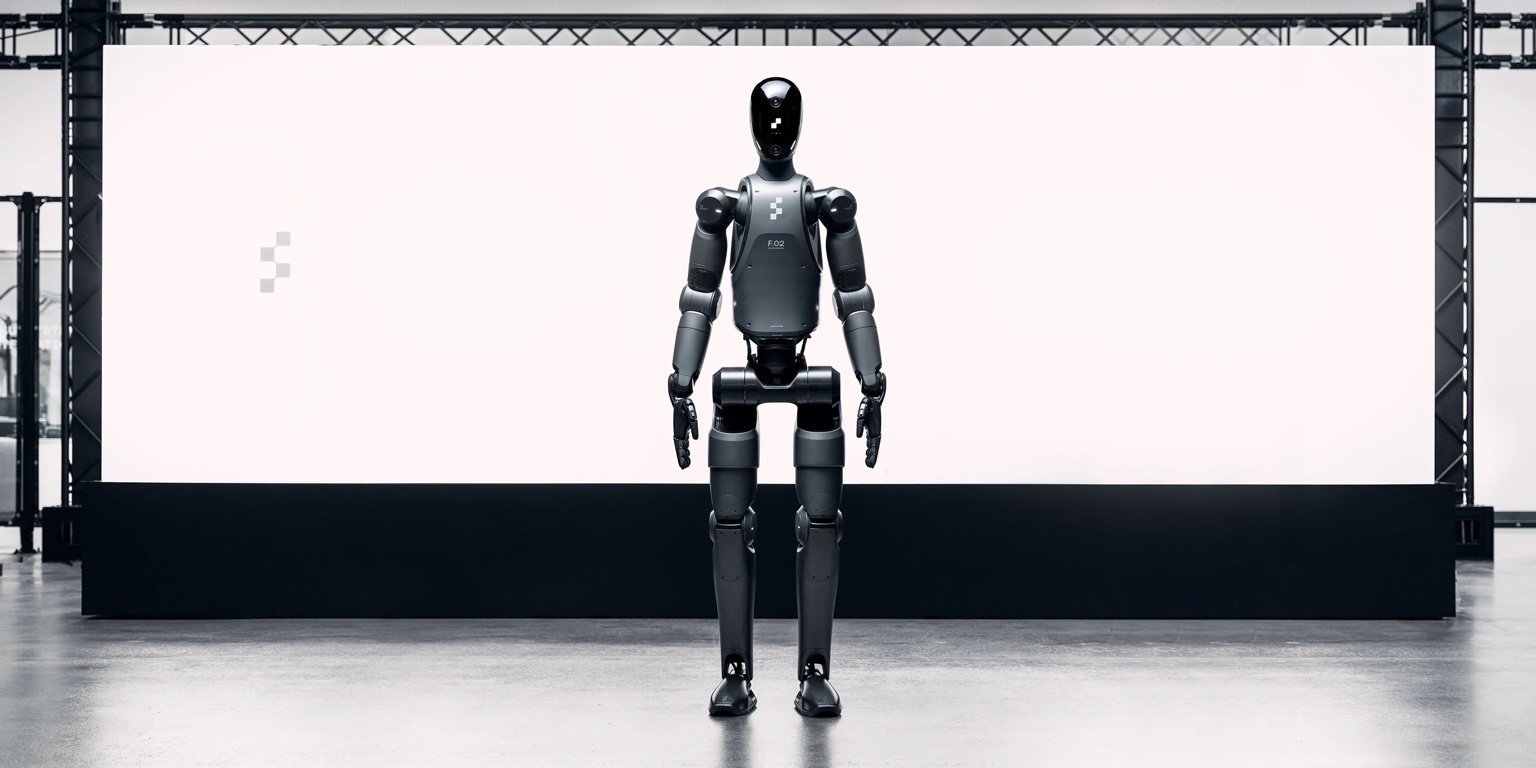

Figure AI’s $39.5 Billion Valuation: A Game-Changer in Humanoid Robotics?

Figure AI is reportedly raising $1.5 billion at a staggering $39.5 billion valuation—15x its February 2024 value. With commercial deals secured and production scaling, it now ranks among the world’s top robotics companies. Is this the future of AI-driven automation?

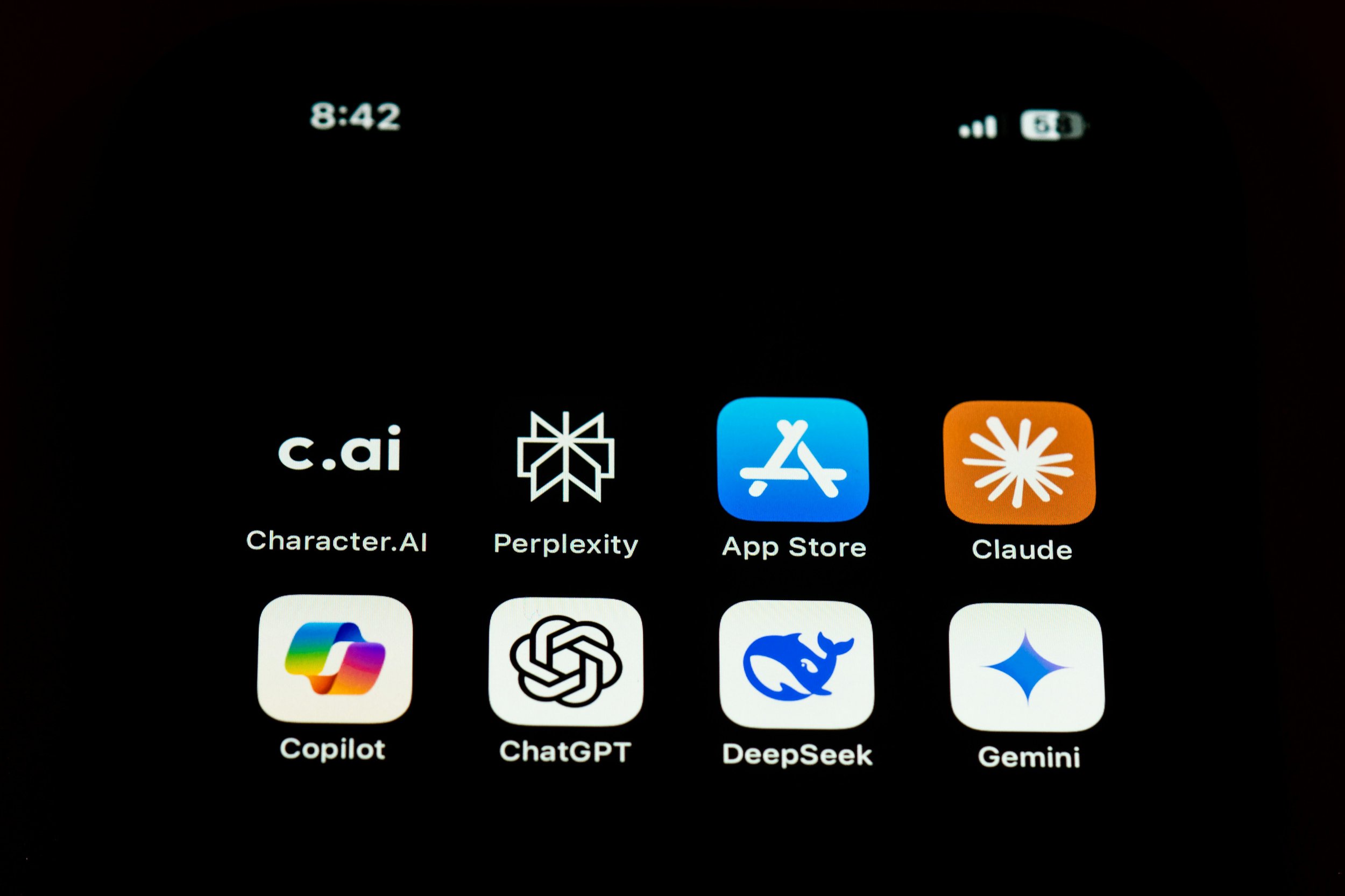

The AI Arms Race: How China tries to Overtake the U.S. by 2030

China is racing to surpass the U.S. in AI dominance by 2030, leveraging state subsidies, aggressive data collection, and alleged IP theft. With companies like DeepSeek and Huawei leading the charge, how can America maintain its edge?

The U.S.-China AI Race: An Ecosystem Problem, Not Just a Technology Gap

We discuss two key sectors of the America 2030 fund that are connected with China.

China’s rapid industrialization is not just about manufacturing dominance—it’s about building an entire ecosystem that supports AI, from infrastructure to energy. With six times the U.S.‘s electrical grid expansion in 2023 alone, China is laying the foundation to dominate AI. This isn’t just a technology race; it’s a systemic shift.

Betting on America Is the Winning Strategy for Investors

The U.S. stock market, driven by "animal spirits" and S&P 500 global exposure, remains the ultimate investment choice. Learn why historical data and expert insights, including Stanley Druckenmiller's comments, reinforce America's consistent market dominance.

#USMarkets #SP500 #Investing #StanleyDruckenmiller #AnimalSpirits #VanguardData #StockMarketPerformance #GlobalExposure #DollarStrength #JohnBogle #AmericanEconomy #InvestorProtections #StableRegulation #EmergingMarkets #MarketAnalysis

Investing in Robotics

Robotics startups have struggled commercially despite significant innovation. Challenges include high R&D costs, technical difficulties, and market saturation. While success stories like Kiva Systems exist, failures have been more common due to difficult economics, margin compression, and integration challenges.

#robotics #startups #innovation #KivaSystems #R&D #margins #commercialization #technology #automation #techindustry #investing #venturecapital #marketchallenges