Flexport numbers look good for IPO

Flexport is a digital, AI-powered freight forwarder and customs broker with ~ a 0.3% market share in the global freight market. In 2021, Flexport moved $19B in gross merchandise value for clients across 112 countries.

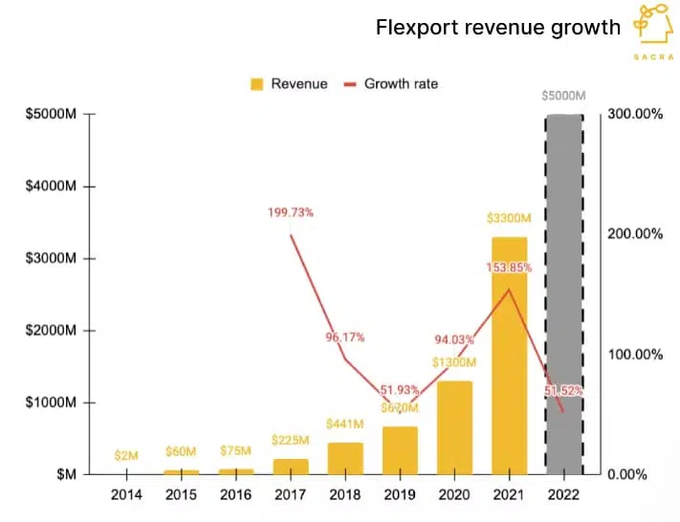

Gross revenue 2021 was $3.3B, up from $1.3B in 2020 and $670M in 2019, while the company projects about $5B in gross revenue by the end of 2022. For freight forwarders, gross revenue is the total amount customers pay to move that volume over the year. Flexport reported a net income margin of around 1.1% against its first profit of $37M on its $3.3B revenue. The company expects not to profit as it invests in growth in the coming years.

In February 2022, Flexport raised $935 million in a Series E funding round- Notable investors include PRE IPO CLUB, DST Global, S.F. Express, and Founders Fund.

Flexport's numbers are looking very good, especially considering its ~$9B valuation, which has taken a beating due to liquidations.